Inflation Estimator (Manual %)

Calculatorsera.com

Inflation Estimator (Manual %) – Master Your Money with Our Inflation Estimator (Manual %)

Inflation Estimator (manual %) Do you ever wonder why your favorite chocolate bar costs double what it did 10 years ago? Or why your grandparents talk about buying a movie ticket for a quarter? That’s inflation in action! It’s like a quiet, invisible force that slowly changes the meaning of a dollar.

But what if you could see into the future? What if you could know how much you need to save for your child’s college, your dream vacation, or a comfortable retirement, even as prices keep rising?

That’s exactly why we built our Inflation Estimator (Manual %). This powerful tool helps you understand how the value of money changes with time. The best part? You are in control. You can enter your own inflation rate to see how much things might cost in the future—or what they were worth in the past. It’s like having a financial crystal ball!

Table of Contents for Inflation Estimator (manual %)

What Is Inflation? (In Simple Words)

Let’s break it down into a simple story.

Imagine you have a magic backpack that can always hold 10 apples. That’s your money. One year, you go to the market, and with the money in your backpack, you can buy 10 apples. The next year, you go back to the same market with the same amount of money, but you find you can only buy 9 apples. Your backpack didn’t get smaller, but the price of apples went up. That’s inflation.

In technical terms, inflation is the rate at which the general level of prices for goods and services is rising. As prices rise, each unit of currency (like your dollar) buys fewer goods and services. So, the value of money over time decreases.

A Kid-Friendly Example:

If you could buy 10 candies for $1 in 2005, maybe you can only buy 5 candies today with the same dollar. Your $1 bill is still a $1 bill, but its purchasing power has been cut in half. That’s the power of inflation!

Why Does Inflation Happen?

Inflation Estimator (manual %) Inflation doesn’t just happen on its own. It’s usually the result of a few key things happening in the economy. Think of it like a seesaw between supply (how much stuff is available) and demand (how much people want to buy that stuff).

1. Increased Demand (Too Much Money Chasing Too Few Goods)

Inflation Estimator (manual %) When people have more money to spend (maybe because they get a pay raise or the government sends out stimulus checks), they start buying more things. If factories and farms can’t produce enough of those things quickly enough, sellers realize they can charge higher prices. Everyone is competing for the same limited supply, so prices go up. This is often called “demand-pull inflation.”

2. Rising Production Costs (It Costs More to Make Stuff)

Inflation Estimator (manual %) Sometimes, the cost of making products increases. For example, if the price of fuel goes up, it becomes more expensive to transport goods to stores. If the price of wheat skyrockets, it costs more to make bread and pasta. Companies don’t want to lose money, so they pass these higher costs on to you, the consumer, by raising their prices. This is known as “cost-push inflation.”

3. Government Policies and Economic Growth

Inflation Estimator (manual %) A little bit of inflation is actually a sign of a healthy, growing economy. When the economy is strong, people have jobs and feel confident spending money. Central banks (like the Federal Reserve in the U.S.) often aim for a low, stable inflation rate, usually around 2%. This encourages people to spend and invest rather than just hoard cash.

The Key Takeaway: A little inflation is normal and healthy, but too much inflation (hyperinflation) makes everything expensive too fast, and that can be very painful for everyone.

What Is an Inflation Estimator (Manual %)?

An Inflation Estimator is a special calculator that helps you figure out how the value of your money changes over time based on an assumed inflation rate. It answers questions like, “Will my $50,000 savings be enough to live on in 20 years?” or “How much would my parents’ first car cost in today’s dollars?”

Now, let’s talk about the “Manual %” part. This is what makes our tool so powerful and flexible.

Most standard inflation calculators online use a fixed, historical average rate. But what if you want to plan for a specific scenario? What if you live in a country with a different inflation rate? Or you’re planning for college costs, which historically rise faster than general inflation?

With our Manual Inflation Rate Calculator, you are the boss. You can enter any inflation percentage you want. You can use your country’s official rate, a historical average, or even your own prediction. This gives you a custom, personalized look at your financial future.

How Does the Inflation Estimator Work? Using It Is as Easy as 1-2-3!

Using our Inflation Estimator is simple and takes just seconds. Here’s a step-by-step guide:

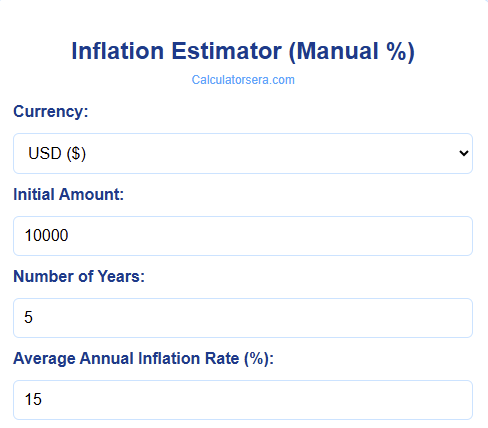

- Enter the Starting Amount: This is the amount of money you’re thinking about. It could be your savings ($10,000), a monthly budget ($3,000), or the price of a single item (a $300 grocery bill).

- Enter the Number of Years: How far into the future do you want to look? Or how far into the past? (e.g., 5, 10, or 20 years).

- Enter Your Manual Inflation Rate: This is where you take control. Enter the annual inflation rate you want to test (e.g., 3%, 5%, or 7%).

- Click Calculate.

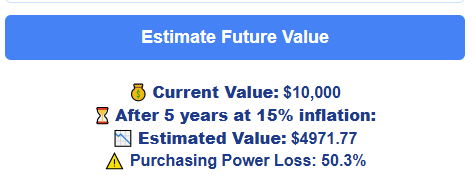

Boom! The tool instantly shows you:

- The future value of your money (how much you’ll need to have the same purchasing power).

- The decrease in purchasing power (how much value your original money has lost).

- The real value of your money adjusted for inflation.

The Magic Formula Behind the Calculator

Inflation Estimator (manual %) Don’t worry, we won’t get too mathy ! But for the curious minds, here’s the simple formula our Inflation Estimator uses. It’s the same formula used for compound interest, because inflation compounds each year, too!

The Formula:Future Value = Present Value × (1 + Inflation Rate) ^ Number of Years

Let’s see it in action with a simple example:

- Present Value: $100 (the cost of a nice dinner today)

- Inflation Rate: 4% per year (or 0.04 in decimal form)

- Number of Years: 10

The Calculation:Future Value = $100 × (1 + 0.04) ^ 10Future Value = $100 × (1.04) ^ 10Future Value = $100 × 1.4802Future Value = $148.02

Inflation Estimator (manual %) So, that dinner that costs $100 today will likely cost about $148.02 in 10 years if inflation averages 4% per year. This is why a future cost calculator is so essential for long-term planning!

Real-Life Examples of Inflation You’ll Recognize

Let’s make this even more real. Here’s how inflation has quietly reshaped the cost of everyday life.

Example 1 – The Shrinking Grocery Bag

In 2010, you could fill a grocery bag with bread, milk, eggs, and some fruit for about $20. Today, that same bag of groceries might cost $30 or more. A specific loaf of bread that cost $1.00 in 2010 might easily be $1.70 today. Our price change estimator can show you this erosion of purchasing power over any time period you choose.

Example 2 – The Climbing Cost of the Pump

Remember when gas was under $2.00 a gallon? For many, it wasn’t that long ago! In 2015, the average price was around $2.50 per gallon. Today, it’s not uncommon to see prices over $3.50. This is a very visible and painful example of inflation.

Example 3 – The Rising Cost of a Roof Over Your Head

Rent is one of the biggest expenses for most people, and it’s been steadily climbing. An apartment that rented for $800 a month 10 years ago could easily be $1,200 or more in the same city today.

Let’s look at this in a table, assuming a steady 3% annual inflation rate:

| Year | Average Rent | Annual Inflation Rate | Annual Rent Increase |

|---|---|---|---|

| 2013 | $800 | 3% | +$24 |

| 2018 | $927 | 3% | +$27 |

| 2023 | $1,075 | 3% | +$32 |

Inflation Estimator (manual %) As you can see, the dollar amount of the increase gets larger each year because inflation compounds. This is a powerful visual of how a manual inflation rate calculator can project your future housing costs.

Chart – Visualizing the Silent Thief: The Impact of Inflation

A chart can often show what words cannot. Below is a visual representation of how $10,000 in savings would be eaten away by inflation over 20 years if it just sat in a box under your bed, not earning any interest.

- The Blue Bar: Your $10,000 today.

- The Red Bar: The purchasing power of that $10,000 in 20 years at a 3% inflation rate.

Interactive Inflation Simulator

What this chart tells you: Even a “low” inflation rate of 3% silently steals almost half of your money’s value over 20 years. Your $10,000 will still be $10,000 in cash, but it will only be able to buy what about $5,500 can buy today. This is why understanding the value of money over time is critical!

Inflation Over Time – A Quick Historical Look

Inflation Estimator (manual %) Let’s see how inflation has played out in recent history. This table shows what $100 from each of these years would be worth in today’s (approx. 2024) dollars.

| Year | Average Inflation Rate (%) | What $100 Then Is Worth Now |

|---|---|---|

| 2000 | 2.8% | ~$172 |

| 2010 | 1.6% | ~$124 |

| 2020 | 2.3% | ~$123 |

| 2024 | 4.1% | ~$118 |

The Simple Takeaway: Even small, seemingly harmless inflation rates slowly but surely reduce the buying power of your money over long periods.

Why Using a Manual % Is a Game-Changer

You might be wondering, “Why can’t I just use a standard calculator with a fixed rate?” Here’s why the Manual % feature is so incredibly useful.

1. Custom Control for Your Reality

The official inflation rate is an average. But your personal inflation might be higher or lower. If you live in a city with skyrocketing rent, your personal inflation rate is higher than someone in a rural area. With our tool, you can model your specific situation.

2. Better Accuracy for Specific Goals

Not all prices rise at the same rate. College tuition and healthcare costs often rise much faster than the official inflation rate. If you’re saving for your child’s education, you can use a 6% or 7% inflation percentage to get a much more accurate and realistic savings goal.

3. Planning for Different Economic Environments

What if you’re worried about high inflation making a comeback? You can run scenarios with 5%, 7%, or even 10% inflation to see how it would impact your long-term plans. This “stress-testing” helps you build a more robust financial plan.

Inflation and Savings – The Hidden Impact You Can’t Ignore

This is perhaps the most important section of this entire post. What you do with your money directly determines whether you beat inflation or let it beat you.

If you keep your cash in a safe or a regular savings account with a very low interest rate, inflation is slowly eroding its value. It’s like a silent tax on your wealth. To truly grow your wealth, you need your money to grow faster than the rate of inflation.

Let’s look at a simple table comparing different options over 20 years with a 4% inflation rate:

| Option | Average Annual Growth | Minus 4% Inflation | Your Real, Inflation-Adjusted Gain/Loss |

|---|---|---|---|

| Cash Under the Mattress | 0% | -4% | You LOSE 4% per year! |

| Bank Savings Account (2%) | 2% | -4% | You still LOSE 2% per year. |

| A Solid Investment (7%) | 7% | -4% | You GAIN a real 3% per year! |

This is why simply “saving” isn’t enough. You need to be “investing” to protect and grow your purchasing power over the long run.

How to Use Calculatorsera.com’s Inflation Estimator (Manual %)

Inflation Estimator (manual %) Ready to try it for yourself? It’s incredibly easy.

- Go to Calculatorsera.com and find the “Inflation Estimator (Manual %)” tool.

- Enter Your Numbers:

- Amount: The sum you’re curious about (e.g., $50,000 for retirement).

- Years: The time frame (e.g., 25 years until retirement).

- Inflation Rate (%): Your custom rate (e.g., 3% for a conservative estimate).

- Hit the “Calculate” Button.

- Instantly see how much that amount will be worth in the future in today’s dollars, or how much you’ll need to have the same purchasing power.

Pro Tip: You can also reverse-calculate! Want to know what your parents’ $20,000 house in 1975 would be worth today? Just use a historical inflation rate and see the magic happen.

Inflation in Your Everyday Life

1. Education Costs

Inflation Estimator (manual %) College tuition has historically risen about 5-7% each year—much faster than general inflation. If you have a newborn, use our Inflation Estimator with a 6% rate to see how much you need to save for their future education. The number might shock you, but it’s better to be shocked now than unprepared later!

2. Travel & Lifestyle

Inflation Estimator (manual %) Dreaming of a European vacation in 10 years? The flights, hotels, and meals will all be more expensive. Use the tool to estimate your future budget and start saving accordingly.

3. Food & Essentials

Inflation Estimator (manual %) Your weekly grocery run is a perfect mini-lab for observing inflation. That $50 weekly shop from five years ago is likely a $70 shop today. Projecting this forward helps you budget more accurately for your future household expenses.

Benefits of Using Calculatorsera.com’s Inflation Estimator

Inflation Estimator (manual %) Why should you use our tool? Here’s what makes it the best inflation calculator for your needs:

- ✅ 100% Free & No Sign-Up: No hidden fees, no email required. Just open and calculate.

- ✅ Manual % Control: The star of the show. Test any scenario with your custom inflation rate.

- ✅ Universal Currency Support: Works with USD, EUR, PKR, INR, or any other currency.

- ✅ Simple and Fast: Get your answers in seconds with our clean, user-friendly interface.

- ✅ For Everyone: Perfect for students learning economics, families planning a budget, and investors building their retirement portfolio.

Common Mistakes People Make with Inflation Estimates

A little knowledge can be dangerous. Avoid these common pitfalls:

- ❌ Using Outdated Inflation Rates: The economy changes. Use recent data or well-researched projections for your manual input.

- ❌ Forgetting Compounding: Inflation’s effect isn’t linear. A 3% rate for 20 years doesn’t mean a 60% increase; it’s more due to compounding. Our calculator handles this for you!

- ❌ Confusing Nominal and Real Value: $1 million in 30 years isn’t the same as $1 million today. Always think in terms of “today’s dollars” (real value).

- ❌ Ignoring Regional Variations: If you plan to retire in another country, research that country’s typical inflation rate.

FAQs About the Inflation Estimator (Manual %)

What inflation rate should I use for my calculation?

You can use your country’s current official rate, a long-term historical average (often 3-3.5% for the US), or a specific rate for a specific goal (like 6% for college tuition).

Can I calculate a past value with this tool?

Absolutely! To find out what a past price would be in today’s dollars, just enter the past amount, the number of years ago it was, and your estimated inflation rate for that period.

Is inflation the same for every product and in every country?

No, not at all! This is a key point. This is why the “Manual %” is so useful. Inflation for healthcare is different from inflation for technology (which often gets cheaper). And inflation in one country can be very different from its neighbor.

Does the tool show real-time inflation data?

No, our Inflation Estimator (Manual %) is designed for you to input your own percentage. This gives you the flexibility to model any scenario, past, present, or future.

Is the Inflation Estimator really free?

Yes! It is 100% free to use on Calculatorsera.com. We believe in providing powerful financial tools to everyone.

H2: How Inflation Affects Your Long-Term Goals

Let’s connect this directly to your dreams:

- Retirement Savings: $1 million might sound like a lot for retirement, but in 30 years at 3% inflation, it will only have the purchasing power of about $400,000 today. Will that be enough?

- College Planning: A university that costs $25,000 per year today could cost over $90,000 per year in 18 years at a 7% education inflation rate.

- Home Buying: If you’re saving for a down payment, remember that the house you want is also going up in price. Your savings need to grow faster than housing inflation.

H2: Conclusion: Don’t Let Inflation Surprise You – Plan for It!

Inflation is like a slow leak in your money’s value—you don’t notice it day-to-day, but over years and decades, it can completely deflate your financial future. Ignoring it is one of the biggest mistakes you can make.

But now, you have the knowledge and the tool to fight back. With Calculatorsera.com‘s Inflation Estimator (Manual %), you can see the invisible. You can peer into the future, understand the past, and make smarter, more informed decisions today.

Whether you’re planning for a major purchase, saving for retirement, or just curious about the economy, this tool puts the power of financial foresight in your hands.

Ready to see your financial future with clear eyes?

👉 Click here to try the Inflation Estimator (Manual %) now on Calculatorsera.com! See how your money’s real value changes with time and take the first step toward smarter financial planning!

Thank you for reading this post, don't forget to subscribe!