Future Value Calculator

Calculatorsera.com

Future Value Calculator – See How Your Money Grows Over Time

What if I told you that the money in your piggy bank or savings account right now has a secret superpower? It can grow all by itself! Imagine you save $100 every month. How much money would you have in 10 years? Is it $1,200? Actually, it could be a lot more. The magic that makes this happen is called compound interest, and the tool that helps you see this magic in action is a Future Value Calculator.

This free, easy-to-use tool on Calculatorsera.com is like a time machine for your money. It lets you peek into the future to see how your savings and investments can grow. Whether you’re saving up for a new bike, a car, college, or even just a bigger emergency fund, understanding your money’s future value is the first step to making smart financial decisions. Let’s dive in and unlock the secrets of your money’s potential!

Table of Contents

What Is Future Value?

Let’s start with a simple idea. Future Value, or FV for short, is simply the amount of money you have today will be worth at a specific date in the future.

Think of it like planting a tiny seed. You don’t just get a seed back in a few years; you get a whole tree! Your money is the seed, and the interest it earns is the water and sunlight that helps it grow.

A Simple Example from Everyday Life:

Let’s say your grandma gives you $100 for your birthday. Instead of spending it right away, you decide to put it in a savings account that pays you 5% interest every year.

- After Year 1: Your $100 has earned $5 in interest (5% of $100). You now have $105.

- After Year 2: You now earn 5% interest on the new total of $105. That’s $5.25. You now have $110.25.

- After Year 3: You earn 5% on $110.25, which is $5.51. Your total is now $115.76.

So, the Future Value of your $100 birthday gift in 3 years is $115.76! You did nothing but wait, and your money grew. This is why knowing the future value is so powerful—it helps you see the reward of being patient with your money.

The Formula for Future Value

Now, let’s look at the “recipe” that makes this magic happen. Don’t worry, it’s not as scary as it sounds! The basic future value formula is:

FV = PV × (1 + r)ⁿ

Let’s break down this secret code:

- FV = Future Value: This is the amount of money you will have in the future—our main goal!

- PV = Present Value: This is the amount of money you are starting with right now (like your $100 birthday money).

- r = Interest Rate per Period: This is the percentage your money grows each year (or month). Remember to use the decimal form, so 5% becomes 0.05.

- n = Number of Periods: This is how long you are investing for, usually in years.

Let’s Plug in Our Example:

We had PV = $100, r = 5% (or 0.05), and n = 3 years.

FV = $100 × (1 + 0.05)³

FV = $100 × (1.05)³

FV = $100 × (1.05 × 1.05 × 1.05)

FV = $100 × 1.157625

FV = $115.76

See? The formula confirms what we figured out step-by-step. While doing this math by hand is great for learning, you can see how it might get tricky with bigger numbers or longer time frames. That’s exactly why we built our Future Value Calculator—to do the hard work for you instantly!

How Does the Future Value Calculator Work?

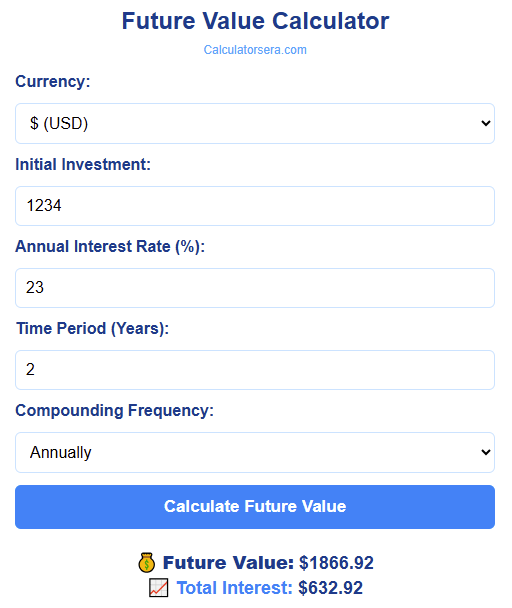

Using the Future Value Calculator on Calculatorsera.com is as easy as 1-2-3. It’s designed to be super simple, so you can focus on your financial future without any stress. Here’s a step-by-step guide:

Step 1: Enter Your Current Amount (Present Value)

This is the lump sum of money you are starting with. It could be $500 from a summer job, $1,000 from your savings, or even $0 if you’re just starting with monthly contributions.

Step 2: Enter the Interest Rate

Type in the annual interest rate you expect to earn on your investment. For example, if your savings account offers 4% per year, just type “4”. The calculator knows what to do!

Step 3: Enter the Number of Years

How long do you plan to let your money grow? If you’re saving for a goal 10 years from now, type “10”.

Step 4: Click “Calculate”!

That’s it! In a flash, the calculator will show you:

- Total Future Value: The final amount you’ll have.

- Total Interest Earned: How much “free money” you made from compound interest.

- A Growth Graph: A visual chart that shows how your money grew over time.

It’s the perfect future investment value calculator for seeing the big picture of your savings journey.

Example Calculations

Let’s make this even clearer with some real-world examples. We’ll use small numbers to keep things simple.

Example 1 – Simple Savings for a New Bike

The Goal: You have $500 saved up from chores, and you want to buy a new bike in 5 years. You put the money in a savings account that pays 4% interest per year. How much will you have?

Using the Future Value Formula:

- PV = $500

- r = 4% or 0.04

- n = 5 years

FV = $500 × (1 + 0.04)⁵

FV = $500 × (1.04)⁵

FV = $500 × 1.21665

FV = $608.33

What this means: Your $500 will grow to over $608! You’ll have an extra $108.33 to put towards a fancier bike or a helmet and pads. By letting your money grow, you rewarded yourself for waiting.

Example 2 – Monthly Investment for a Bigger Goal

The Goal: You want to build a college fund by saving $100 of your allowance every month for 10 years. You find an investment that earns an average of 6% per year.

This is where our Future Value Calculator really shines because it can handle monthly contributions. You’d simply:

- Enter $0 as your starting Present Value (since you’re starting from scratch).

- Enter your monthly contribution: $100.

- Enter the annual interest rate: 6%.

- Enter the time: 10 years.

Future Value Calculator After clicking calculate, you’d find out that your total contributions would be $12,000 ($100 x 12 months x 10 years). But thanks to compound interest future value, the total in your account would be approximately $16,387. You earned over $4,300 in interest! This shows the incredible power of saving small amounts regularly over time.

Example 3 – Long-Term Goal (A Dream Fund)

Future Value Calculator The Goal: Your parents invested $5,000 for you when you were born, hoping to give it to you for a down payment on a house when you turn 20. The investment earns 7% per year. What will it be worth?

Using the Calculator:

- PV = $5,000

- r = 7%

- n = 20 years

The future value of investment would be a whopping $19,348! The initial $5,000 more than tripled because it had a long time to grow.

Comparison Table: See the Power of Time and Rate

| Initial Investment | Interest Rate | Time (Years) | Future Value |

|---|---|---|---|

| $1,000 | 5% | 5 | $1,276 |

| $5,000 | 7% | 20 | $19,348 |

| $10,000 | 10% | 10 | $25,937 |

As you can see, the longer your time and the higher your rate, the more your money multiplies!

Chart: Visualizing Your Future Value Growth

A picture is worth a thousand words, and a chart is worth a thousand numbers! Let’s look at the $5,000 investment from Example 3. Here’s how that $19,348 breaks down:

This chart shows the magic clearly. The blue part ($5,000) is your original investment. The yellow part ($14,348) is the interest your money earned over 20 years—that’s the “free money” generated by compound interest! The longer you wait, the bigger the yellow slice gets.

Why Future Value Matters

Future Value Calculator Understanding future value isn’t just a math exercise; it’s a superpower for your life. Here’s why:

- It Helps You Set Realistic Goals: Want to have $50,000 for college in 15 years? A Future Value Calculator can tell you how much you or your parents need to save each month to reach that goal.

- It Motivates You to Save: When you see that your $50 a month can turn into $10,000 in 10 years, you’re more likely to think twice before spending it on something you don’t really need.

- It Makes You a Smart Investor: By comparing the future value of different investments (like a savings account vs. a stock market fund), you can choose the option that helps your money grow fastest.

- It Teaches Patience: The biggest gains happen in the later years. This teaches you that building wealth is a marathon, not a sprint.

Difference Between Future Value and Present Value

Future Value Calculator This is a common point of confusion, but it’s simple once you think about time travel!

| Comparison | Future Value (FV) | Present Value (PV) |

|---|---|---|

| Definition | The value of money in the future. | The value of money today. |

| The Question It Answers | “If I invest $1,000 today, what will it be worth in 10 years?” | “How much do I need to invest today to have $10,000 in 15 years?” |

| Time Direction | Looking Forward | Looking Backward |

Think of it as looking forward versus looking backward. Future Value shows you the growth potential of the money in your hand today. Present Value helps you figure out how much you need to start with to reach a future goal. Both are incredibly useful for planning!

Benefits of Using Calculatorsera.com’s Future Value Calculator

Future Value Calculator Why should you use our tool? Here are the top reasons:

✅ Incredibly Easy to Use: Just enter your numbers and get instant results. No confusing menus or financial jargon.

✅ 100% Free and Accessible: There are no hidden fees or subscriptions. It works perfectly on your phone, tablet, or computer.

✅ Accurate and Powerful: It calculates compound interest future value correctly, so you can trust the numbers you see.

✅ Saves You Time and Stress: No more complex math or spreadsheet formulas. Get your answers in seconds.

✅ Perfect for Everyone: Whether you’re a student planning for college, a young adult saving for a car, or a parent planning for retirement, this tool is for you.

FAQs About Future Value Calculator

Can I calculate monthly investments with this Future Value Calculator?

Yes! Our calculator on Calculatorsera.com allows you to input both a starting lump sum and regular monthly contributions. This makes it a powerful future investment value calculator for any savings plan.

What is the difference between simple and compound interest?

Simple interest is earned only on your original investment. Compound interest, which is what our calculator uses, is “interest on interest.” You earn returns on both your original money AND the interest it has already earned, leading to much faster growth.

Can I use the calculator for business projections?

Absolutely! If you’re thinking of starting a lemonade stand and want to see how reinvesting your profits could grow your business, the Future Value Calculator is a perfect tool for forecasting.

Is the calculator really free?

Yes! All tools on Calculatorsera.com are completely free to use. Our goal is to help everyone make smarter financial decisions.

Future Value vs Compound Interest

These two ideas are best friends, but they are not the same thing.

- Compound Interest is the engine or the process. It’s the mechanism where you earn interest on your interest.

- Future Value is the destination or the outcome. It’s the final amount you arrive at after the engine of compound interest has done its work over time.

So, compound interest is the magic trick, and future value is the rabbit that comes out of the hat!

Common Mistakes to Avoid

When you start using the future value formula or a calculator, watch out for these simple errors:

- Not Converting the Interest Rate: Always remember to use 0.05 for 5%, not just “5”, if you’re doing manual math. (The calculator on our site does this for you automatically!).

- Mixing Up Time Units: If your interest rate is yearly, make sure your time period is also in years. Don’t use months for ‘n’ with a yearly ‘r’.

- Ignoring Compounding Frequency: Interest can compound annually, monthly, or daily. Our standard calculator uses annual compounding for simplicity, but more frequent compounding leads to slightly higher returns.

- Forgetting About Inflation: The future value tells you a number, but that number might not buy as much in the future due to rising prices (inflation). It’s a great measure of growth, but remember that the actual purchasing power might be a little less.

Conclusion

Every big financial journey begins with a single step—and a single dollar. Understanding how your money can grow is the key to turning your small savings into a significant sum. The Future Value Calculator is your guide, your crystal ball, and your personal financial coach, all rolled into one.

It shows you that time is your greatest ally and that starting early is the smartest move you can make. You don’t need to be a math whiz or a Wall Street expert. You just need a little curiosity and the right tool.

So, what are you waiting for? Your financial future is ready to be planned.

👉 Try the Future Value Calculator now on Calculatorsera.com and start growing your savings smartly!

Thank you for reading this post, don't forget to subscribe!