Compound Interest Calculator

Calculatorsera.com

Calculate compound interest easily with different compounding frequencies.

Formula: A = P (1 + r/n)nt

Introduction Compound interest calculator

Compound interest calculator Ever heard your parents or a teacher say, “Let your money grow!”? They were talking about one of the coolest ideas in the whole world of money: compound interest.

Imagine you plant a single magic seed. The next day, a small plant sprouts. But this plant is special—it grows new seeds every single day, and those new seeds also start growing into plants. In no time, you don’t have just one plant; you have a whole forest! Compound interest works the same way with your money. It’s the magic that happens when your money starts earning its own money.

But how fast will your money forest grow? That’s where our super-smart, free online tool comes in: the Compound Interest Calculator. It’s like a crystal ball for your savings, showing you exactly how your money can multiply over days, months, and years. Let’s dive in and unlock the secret to making your money work hard, even while you sleep!

Table of Contents

What Is Compound Interest? (Explained Simply)

In simple words, compound interest means you earn “interest on your interest.”

Let’s break that down with a fun example.

Compound interest calculator

Imagine you have $100. You put it in a savings account that pays 10% interest per year. (We’re using 10% to make the math easy!)

- After Year 1: You earn 10% of $100, which is $10. Now you have $110.

- Your original $100 + $10 interest = $110.

Now, here’s the magic part.

- After Year 2: You don’t earn 10% on just your original $100. You earn 10% on the entire $110!

- 10% of $110 is $11. So now you have $121.

- Your original $100 + $10 interest (from Year 1) + $11 interest (from Year 2) = $121.

See what happened? In the first year, you earned $10 in interest. In the second year, you earned $11. Your interest itself earned $1! That might not seem like much, but over a long time, this snowball effect gets huge.

A Simple Analogy: Think of compound interest like rolling a snowball down a big, snowy hill. At the top, your snowball is small (your initial money). As it rolls, it picks up more snow (the interest). The bigger it gets, the more snow it picks up with each roll. Soon, you have a giant snowball!

Simple Interest vs. Compound Interest

Compound interest calculator How is compound interest different from the regular kind? Let’s compare.

Simple Interest is straightforward. You only earn interest on the original amount of money you put in (called the principal).

- Example: You invest $100 at 10% simple interest for 3 years.

- Each year, you earn 10% of $100 = $10.

- After 3 years, you have your original $100 + ($10 x 3) = $130.

Compound Interest is more powerful. You earn interest on the principal and on the interest that keeps getting added.

- Example: You invest $100 at 10% compound interest for 3 years.

- Year 1: $100 + $10 = $110

- Year 2: $110 + $11 = $121

- Year 3: $121 + $12.10 = $133.10

Look at the difference!

| Feature | Simple Interest | Compound Interest |

|---|---|---|

| Interest is earned on… | The original amount only | The original amount + all past interest |

| Growth Speed | Slow and steady | Fast and accelerating (like a rocket!) |

| Total after 3 years | $130 | $133.10 |

| Best for… | Short-term loans | Long-term savings and investments |

As you can see, compound interest grows your money much faster than simple interest. The longer you leave your money, the bigger the gap becomes.

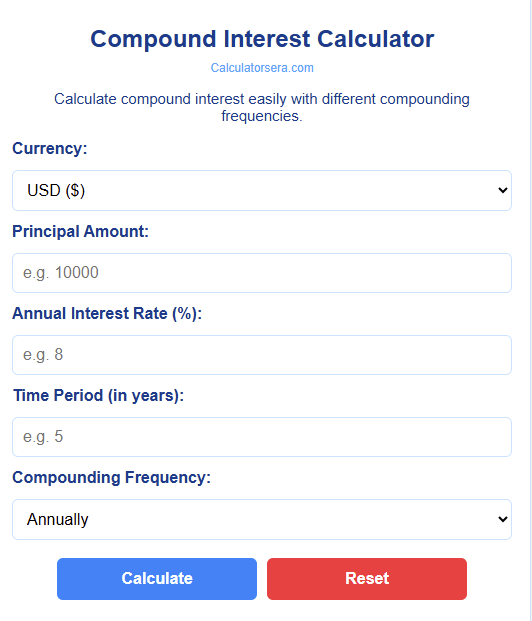

How Does a Compound Interest Calculator Work?

Our Compound Interest Calculator does all the tricky math for you in a flash! You just need to plug in a few simple numbers. Here’s a step-by-step guide:

Step 1: Enter the Principal Amount

This is the fancy word for the money you start with. It could be $50 from your birthday, $1,000 from your first job, or any amount you want to save or invest.

Step 2: Enter the Interest Rate

This is the percentage your money will earn each year. Your bank or investment account will tell you this rate (e.g., 2% for a savings account, 7% for the stock market).

Step 3: Enter the Time

How long do you plan to leave your money to grow? This is usually in years. The longer, the better!

Step 4: Choose the Compounding Frequency

This is how often your interest is calculated and added to your pile. The options are usually:

- Yearly (Once a year)

- Monthly (Every month)

- Daily (Every day)

Step 5: Click “Calculate”!

Compound interest calculator Boom! The calculator instantly shows you two magic numbers:

- The Total Future Value: How much money you’ll have at the end.

- The Total Interest Earned: How much “free money” you made from compounding.

Behind the scenes, the calculator uses a special math formula to figure this out. Let’s look at that formula—don’t worry, we’ll make it simple!

Formula Behind Compound Interest (Made Simple)

Compound interest calculator Here is the standard formula for compound interest:

A = P (1 + r/n)^(nt)

Looks like secret code, right? Let’s decode it together:

- A = the Final Amount of money you’ll have after the interest is applied.

- P = Principal (the amount of money you start with).

- r = the annual interest rate (in decimal form, so 5% becomes 0.05).

- n = the number of times interest is compounded per year (e.g., yearly=1, monthly=12, daily=365).

- t = the time the money is invested for, in years.

Let’s Try an Example:

You invest $1,000 (P) at a 10% annual interest rate (r = 0.10) for 3 years (t = 3), and the interest is compounded once a year (n = 1).

Plugging the numbers into the formula:

A = 1000 (1 + 0.10/1)^(1 * 3)

A = 1000 (1 + 0.10)^3

A = 1000 (1.10)^3

A = 1000 (1.10 * 1.10 * 1.10)

A = 1000 * 1.331

A = $1,331

See? That matches our earlier example! You started with $1,000 and ended with $1,331 without adding any more money. Your money worked hard for you and earned $331 all by itself.

Chart Section (Visual Representation)

Compound interest calculator A picture is worth a thousand words! The chart below shows how compound interest grows over time compared to simple interest. Notice how the compound interest line starts to curve upwards steeply? That’s the snowball effect in action!

This chart assumes an initial investment of $1,000 at a 10% annual interest rate over 30 years. The red line shows simple interest, while the green line shows the powerful effect of compound interest.

Real-Life Examples of Compound Interest

Compound interest calculator Let’s see how this works in real life with some stories.

Example 1: Saving for a Big Birthday Gift 🎁

- Goal: Leo wants to buy a cool new gaming console in 5 years.

- Plan: He decides to save $100 every month.

- Action: He puts it in an account that earns 5% annual interest, compounded monthly.

- Result: After 5 years, Leo didn’t just save $6,000 ($100 x 60 months). Thanks to compound interest, his total is over $6,800! He earned $800 for free, just by starting early and being consistent.

Example 2: Building a College Fund 🎓

- Goal: Maria’s parents want to help pay for her college.

- Plan: When Maria is born, they start investing $50 a month.

- Action: They choose an investment that averages 7% annual return, compounded monthly.

- Result: By the time Maria turns 18, they have contributed $10,800. But because of compound interest, the fund is worth over $21,800! Their money more than doubled because they gave it time to grow.

Example 3: Planning for Retirement 💼

- Goal: Sam, age 25, wants to be comfortable when he retires at 65.

- Plan: He invests $200 every single month.

- Action: He puts it in a retirement account that earns 8% per year, compounded monthly.

- Result: After 40 years, Sam contributed a total of $96,000. But his retirement account? It’s worth over $700,000! The power of time and compounding turned his steady savings into a fortune.

Benefits of Using a Compound Interest Calculator

Compound interest calculator Why should you use our calculator?

- Quick & Accurate: Get answers in seconds, with no math errors.

- Visualize Your Future: It turns boring numbers into an exciting picture of your financial future.

- Saves Time: No need for complicated spreadsheets or long calculations.

- Compare Options: Easily test different interest rates, timeframes, and amounts to see what works best for your goal.

- Boosts Motivation: Seeing how much you can earn motivates you to start saving and investing right now.

Factors That Affect Compound Interest

Compound interest calculator Four main things control how fast your money snowball grows:

- Principal (P): The Starting Amount. The more money you start with, the bigger your snowball is from the beginning. Even small amounts add up!

- Interest Rate (r): The “Growth Fuel.” A higher interest rate means your money grows faster each year. A difference of just 1% or 2% can mean thousands of dollars over time.

- Time (t): Your Best Friend. This is the most important factor. The longer you leave your money alone, the more time it has to compound. Starting early is the ultimate superpower.

- Compounding Frequency (n): The “Growth Speed.” How often your interest is added matters. Daily compounding grows your money faster than monthly, which grows faster than yearly.

Compound Frequency Explained (Yearly, Monthly, Daily)

Compound interest calculator Let’s see how often we add snow to the snowball!

- Yearly Compounding: Interest is calculated and added to your account once at the end of the year.

- Monthly Compounding: Interest is calculated and added at the end of each month. This is better because your balance grows a little every month, and next month’s interest is calculated on that slightly larger amount.

- Daily Compounding: Interest is calculated and added every single day. This is the best option for savers because your money is growing literally every day.

Fun Example: If you put $1,000 in an account with 5% interest for one year:

- Compounded Yearly, you’d have $1,050.00.

- Compounded Monthly, you’d have $1,051.16.

- Compounded Daily, you’d have about $1,051.27.

The differences seem small at first, but over many years, they become significant!

Why Compound Interest Is Called “The 8th Wonder of the World”

Compound interest calculator A very smart scientist named Albert Einstein is often credited with calling compound interest the “eighth wonder of the world.” He supposedly said, “He who understands it, earns it; he who doesn’t, pays it.”

Why is it so wonderful? Because it’s a powerful, automatic force that works for you 24/7. It doesn’t require you to be a genius; it just requires you to be patient. Small, consistent actions, when given enough time, can create unbelievable results. It’s why a young person who saves a little bit regularly can end up with more money than someone who starts saving much larger amounts later in life.

How to Use the Calculator for Smart Financial Goals

You can use our Compound Interest Calculator for so many things!

- Savings Accounts: See how much your emergency fund or vacation savings can grow.

- Investments: Project the growth of your stock market investments (like index funds).

- Kids’ Education Fund: Plan how much to save each month for your child’s future.

- Retirement Planning: Figure out if you’re on track for a comfortable retirement.

- Business Planning: Project how profits from a lemonade stand could grow if you reinvest them!

Tips for Maximizing Compound Interest

Want to make the most of this wonder? Follow these rules:

- Start as Early as Possible: Time is the secret ingredient. Don’t wait!

- Be Consistent: Add money to your savings or investments regularly.

- Don’t Touch It: Let the snowball roll. Withdrawing money interrupts the compounding magic.

- Look for Higher Rates: Compare banks and investment options to get the best return.

- Reinvest Everything: Always reinvest your earnings (like dividends) to buy more shares that can compound.

Common Mistakes to Avoid Compound interest calculator

- Ignoring the Compounding Frequency: A 5% rate compounded daily is better than 5% compounded yearly.

- Forgetting About Inflation: The cost of things goes up over time. Make sure your interest rate is higher than the inflation rate to truly grow your wealth.

- Cashing Out Early: Taking money out, especially in the beginning, drastically reduces your long-term growth.

- Waiting to Start: The biggest mistake of all is thinking “I’ll start next year.” The best time to plant a tree was 20 years ago. The second-best time is today.

Compound Interest Table (Example)

Here’s a simple table showing how $1,000 grows at 10% annual compound interest:

| Year | Balance ($) | Interest Earned that Year |

|---|---|---|

| 1 | 1,100 | 100 |

| 2 | 1,210 | 110 |

| 3 | 1,331 | 121 |

| 4 | 1,464 | 133 |

| 5 | 1,611 | 147 |

Notice how the “Interest Earned” column gets bigger each year? That’s the power of compounding!

FAQs (Frequently Asked Questions)

What is compound interest in simple words?

It’s “interest on interest.” You earn money not only on your original savings but also on all the interest that money has already earned.

How is it different from simple interest?

Simple interest is earned only on the original amount. Compound interest is earned on the original amount plus all accumulated interest, so it grows much faster.

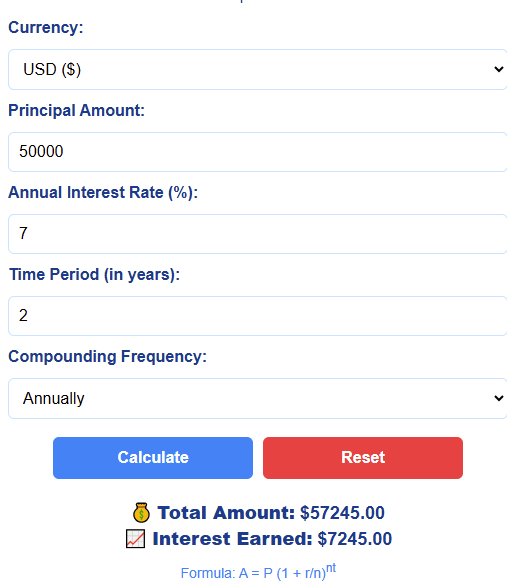

How do I use the Compound Interest Calculator on Calculatorsera.com?

Just enter your starting amount, interest rate, time period, and how often the interest is compounded. Click “Calculate,” and you’ll instantly see your future balance and total interest earned.

Can I calculate monthly compounding?

Absolutely! In the “Compounding Frequency” dropdown, simply select “Monthly.”

What happens if I invest for a longer time?

Time is the best friend of compound interest. The longer you invest, the more dramatic the growth becomes because your interest has more time to earn its own interest.

Is compound interest good or bad?

It’s fantastic when you are earning it (like with savings or investments). It can be bad when you are paying it (like on a credit card debt that grows over time).

Can I use it for loans too?

Yes! The same concept applies to debt. If you have a loan with compound interest, you’ll owe interest on the interest you haven’t paid, which can make the debt grow quickly. This is why paying off credit cards is so important.

Is the calculator on Calculatorsera.com free?

Yes! Our Compound Interest Calculator is completely free to use as many times as you want. No sign-up or hidden fees.

Fun Facts About Compound Interest

- The idea of compound interest is over 4,000 years old! It was used in ancient Babylon.

- There’s a “Rule of 72” that helps you estimate how long it takes to double your money. Just divide 72 by your interest rate. For example, at 10% interest, your money doubles in about 7.2 years (72 ÷ 10 = 7.2).

- If a lucky person had invested a single $1 coin at 5% interest 100 years ago, it would be worth over $130 today!

Conclusion

So, what’s the big takeaway? Compound interest is a simple but incredibly powerful way to grow your wealth over time. It rewards patience, consistency, and starting early. You don’t need to be rich to begin; you just need to start.

The Compound Interest Calculator on Calculatorsera.com is your free guide to this amazing financial journey. It turns the complex formula into a simple, visual plan for your future. Whether you’re a student saving for a bike, a parent building a college fund, or someone planning for retirement, this tool is for you.

Start today — even your smallest savings can grow into something big tomorrow!

You may also find our other calculators helpful: [Simple Interest Calculator], [Loan Calculator], and [Savings Calculator].

Thank you for reading this post, don't forget to subscribe!