Payback Period Calculator

Payback Period Calculator — A Complete Step-by-Step Guide (2026 Edition)

If you’ve ever wondered how long it will take to recover your investment, the Payback Period Calculator is one of the simplest and smartest tools you can use. Whether you’re starting a small business, buying equipment, planning a project, or comparing investment options, knowing your payback period helps you make decisions with confidence.

In this detailed guide, I’ll explain everything in a friendly, simple, and human way — with real-life examples, clear formulas, step-by-step instructions, and answers to the most common questions people ask.

The Payback Period Calculator is an essential tool for investors seeking to evaluate the time required to recoup their initial expenditures. By providing a clear and concise analysis, it facilitates informed decision-making in various financial scenarios, such as business ventures or project planning. This comprehensive guide will equip you with the necessary knowledge and techniques to effectively utilize the Payback Period Calculator, ensuring you can assess your investments with accuracy and confidence. Embrace this valuable resource to enhance your financial strategies and optimize your investment outcomes.

Let’s begin!

Table of Contents

What Is a Payback Period Calculator?

A Payback Period Calculator is a financial tool that tells you how long it takes to recover the initial investment you made in a project or asset.

In simple words:

Payback Period = Time taken to get your money back.

For example:

- You invest ₹100,000 in a small food stall.

- It earns ₹20,000 profit every month.

- You recover your investment in 5 months.

That 5 months is your payback period.

A Payback Period Calculator automates this process by calculating:

✔ Initial investment

✔ Cash inflow per month or year

✔ Total time needed to break even

✔ Cumulative return over time

You can quickly compute this using the Payback Period Calculator on your website.

Why Payback Period Is Important (With Simple Real-Life Examples)

The payback period matters because it answers one of the most important business questions:

“How long will it take to get my money back?”

Here are real-life examples showing why it’s important:

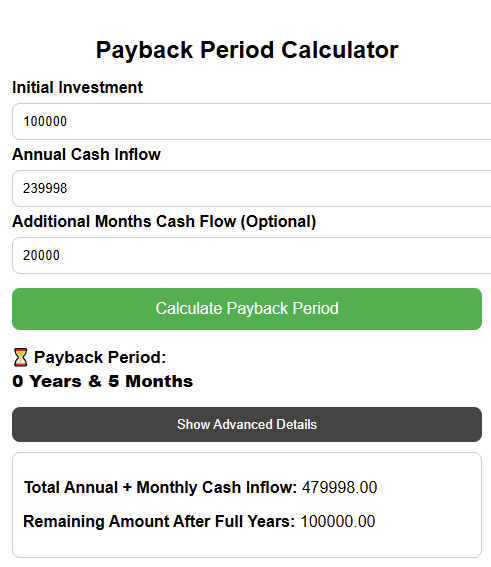

Example 1: Small Business Investment

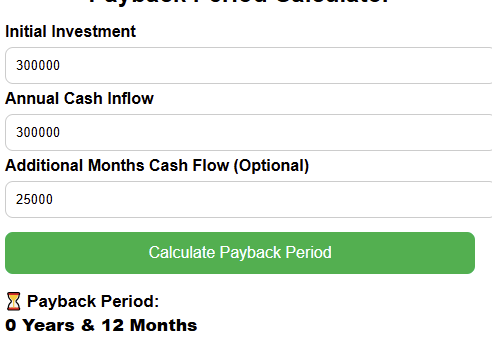

Imagine you start a mini-mart with an investment of ₹300,000.

Your average earnings per month are ₹25,000.

Payback = ₹300,000 ÷ ₹25,000 = 12 months

If the payback is too long, you might reconsider the investment.

Example 2: Buying a Machine for a Factory

A machine costs $18,000.

It saves the company $6,000 per year in labor.

Payback = $18,000 ÷ $6,000 = 3 years

If another machine gives payback in 2 years, that one might be better.

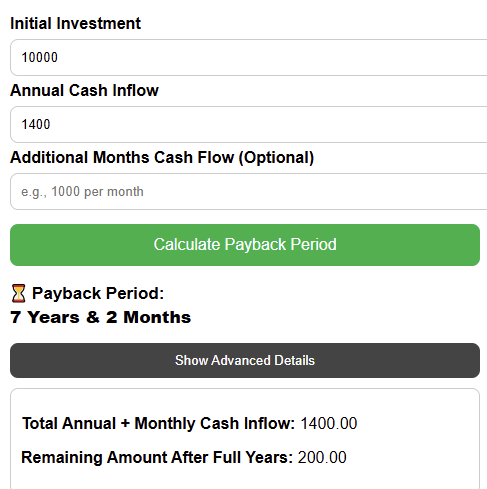

Example 3: Solar Panel Installation

Cost of solar setup: $10,000

Electricity savings per year: $1,400

Payback = 10,000 ÷ 1,400 ≈ 7.14 years

People often ask: “What is a good payback period?”

We will cover this in Part 2.

Why It Matters Globally

Whether someone lives in India, UAE, USA, UK, Pakistan, or Africa — payback period is universal because:

- It’s easy to calculate

- It helps compare projects

- It reduces risk

- It helps in planning future savings

- It tells you how quickly you recover costs

This is why investors, students, entrepreneurs, and financial analysts use it every day.

How to Calculate Payback Period — Step-by-Step Guide

Calculating the payback period manually is simple.

There are two types of situations:

Case 1 — When Cash Inflow Is the Same Every Year

Use this method when earnings or savings are constant.

Formula:

Payback Period = Initial Investment ÷ Annual Cash InflowExample:

Investment: $20,000

Cash Inflow: $5,000 each year

Payback = 20,000 ÷ 5,000 = 4 years

Case 2 — When Cash Inflows Are Uneven

If a project earns different amounts each year, use a cumulative method.

Example:

Investment = $50,000

Yearly returns:

- Year 1: $10,000

- Year 2: $15,000

- Year 3: $20,000

- Year 4: $10,000

Cumulative:

- End of Year 1: $10,000

- End of Year 2: $25,000

- End of Year 3: $45,000

- End of Year 4: $55,000 (break-even happens here)

Payback Period = 3 + (5,000 / 10,000)

= 3.5 years

Case 3 — Monthly Payback Calculation

If monthly cash flow is known:

Payback Period (months) = Initial Investment ÷ Monthly Cash InflowExample:

Investment = ₹120,000

Monthly profit = ₹10,000

Payback = 120,000 ÷ 10,000 = 12 months

This is often used for small businesses, shops, machines, and rental income.

Payback Period Formulas Explained

Here are the most commonly used formulas and their meaning:

1. Simple Payback Period Formula

PBP = Initial Investment ÷ Annual Cash InflowBest for constant yearly returns.

2. Discounted Payback Period Formula

This method considers the time value of money.

Discounted Cash Flow = Cash Inflow / (1 + r)^nThen calculate payback using discounted values.

3. 5-Year Payback Period Formula

Frequently used for equipment and business projects:

5-Year Payback = Total 5-Year Cash Inflow – InvestmentPeople commonly ask “How to calculate payback period for 5 years?” — this formula works for that.

4. Customer Payback Period Formula

Used in marketing and subscription businesses:

Customer Payback = Customer Acquisition Cost ÷ Monthly Revenue per CustomerExample:

CAC = $40

Monthly revenue = $8

Payback = 5 months

Real-Life Examples of Payback Period (Simple & Practical)

Let’s look at some relatable examples using rupees, dollars, and business scenarios.

Example 1: Food Delivery Startup

Investment: ₹500,000

Profit per month: ₹45,000

Payback = 500,000 ÷ 45,000 ≈ 11.1 months

This is considered a very good payback for startups.

Example 2: Tech Product Launch

Investment: $120,000

Yearly earnings:

- Year 1: $20,000

- Year 2: $30,000

- Year 3: $40,000

- Year 4: $50,000

Cumulative until Year 3 = $90,000

Need = $30,000 more

Year 4 earnings = $50,000

Fraction of Year 4 = 30,000 / 50,000 = 0.6

Payback = 3.6 years

Example 3: YouTube Channel Investment

You invest in equipment: $3,000

Monthly earnings after 1 year: $300

Payback = 3,000 ÷ 300 = 10 months

Example 4: Cafe Setup

Investment: ₹800,000

Monthly net profit: ₹65,000

Payback = 800,000 ÷ 65,000 ≈ 12.3 months

Example 5: Solar System + Generator Combo

Investment: $9,000

Yearly savings: $1,200

Payback = 9,000 ÷ 1,200 = 7.5 years

Where You Can Insert Internal Links

Use sentences like:

- “You can quickly calculate this using our Payback Period Calculator on your website.”

- “To compare investments, you can also try our ROI Calculator or NPV Calculator.”

Common Mistakes People Make When Calculating Payback Period

Even though the payback period is one of the simplest financial metrics, people still make mistakes that affect their decisions. Here are the most common ones:

1. Ignoring Monthly vs Yearly Cash Flow

Some people mix monthly earnings with annual investment values.

Always use the same unit.

Example:

Investment: ₹240,000

Monthly profit: ₹20,000

If you wrongly treat it as yearly profit, your payback becomes incorrect.

2. Forgetting Tax, Fees, or Operational Costs

Actual returns may be lower due to:

- rental fees

- maintenance cost

- salaries

- electricity bill

- delivery charges

- marketing cost

These reduce your real cash inflow.

3. Assuming Cash Inflow Is Constant

Not all businesses generate the same return every year.

Seasonal businesses (ice cream shop, travel agency, event management) may have fluctuating earnings.

4. Confusing Payback Period With ROI

People often think a shorter payback period means higher profit.

But it only shows how fast you recover money, not how much you earn overall.

We will explain ROI vs Payback in detail below.

5. Not Using a Calculator for Complex Cash Flows

When inflows vary, manual calculation becomes confusing.

An online Payback Period Calculator simplifies this instantly.

Tips & Best Practices to Get Accurate Payback Estimates

Here are practical tips to help you analyze investments more professionally:

✔ Tip 1: Use Realistic Cash Inflows

Don’t assume every month will be perfect. Use expected average figures.

✔ Tip 2: Consider Hidden Costs

Include depreciation, maintenance, fuel, salaries, interest, and marketing costs.

✔ Tip 3: Combine Payback With NPV + IRR

Payback alone does not show profitability or time value of money.

That’s why businesses check:

- NPV (Net Present Value)

- IRR (Internal Rate of Return)

- ROI (Return on Investment)

You can add internal links like:

“Try our NPV Calculator or ROI Calculator for deeper analysis.”

✔ Tip 4: Compare Multiple Projects

Choose the option with the shortest payback if all other benefits are equal.

✔ Tip 5: Use a Payback Period Calculator for Accuracy

Especially for:

- uneven cash flows

- multi-year projects

- long-term investments

- discounted payback analysis

Manual calculations can easily lead to errors.

When Should You Use an Online Payback Period Calculator Instead of Doing It Manually?

You should definitely use an online calculator when:

1. The Cash Flow Is Uneven

Example:

Year 1: ₹50,000

Year 2: ₹80,000

Year 3: ₹30,000

Calculating cumulative returns manually can be time-consuming.

2. You Want Instant and Accurate Results

Businesses need quick decision-making.

An online calculator gives results in one click.

3. You’re Comparing Multiple Projects

You can easily compare:

- solar investment vs generator

- machine A vs machine B

- shop rent vs online store

- car rental vs delivery business setup

4. You’re New to Financial Calculations

Students, beginners, entrepreneurs, and small business owners benefit greatly from automatic calculators because they remove all confusion.

5. Visualization

These visuals help you understand investment performance clearly.

The Payback Period Calculator efficiently determines the duration required for an investment to be recouped through generated cash flows. By analyzing cumulative cash flows and visualizing the data, it provides a clear insight into investment recovery timelines.

People Also Ask

How to calculate a payback period?

Use the formula:

Payback = Initial Investment ÷ Annual Cash InflowIf cash inflow varies, calculate year-by-year cumulative returns until the investment amount is recovered.

How to calculate payback period for 5 years?

Add the cash inflow for 5 years and compare it with the initial investment.

If cumulative inflow reaches the investment before 5 years, note the year and calculate the remaining fraction.

How to quickly calculate payback period?

Use the simple formula:

Payback = Cost ÷ Cash Inflow

or instantly compute it using an online Payback Period Calculator.

How to calculate monthly payback?

Monthly Payback (months) = Investment ÷ Monthly ProfitHow to calculate payback period manually?

- Write the initial investment

- List yearly or monthly inflows

- Add inflows cumulatively

- Stop when the total equals the investment

- Calculate remaining fraction

How to solve payback period in Excel?

Use cumulative formulas:

- Column A: Year

- Column B: Cash flow

- Column C: Cumulative sum

Payback occurs when Column C reaches investment cost.

H3: How to calculate PBP in Excel?

Use =MATCH() and =VLOOKUP() functions to identify the year when cumulative cash inflow equals investment.

How to use IRR formula in Excel?

Use the formula:

=IRR(CashFlowRange)Example: =IRR(B2:B7).

What is the formula for payback period in ACCA?

ACCA uses:

Payback = Amount to Recover / Cash Flow in Next Yearor the standard simple formula.

What is the payback period rule?

A project is accepted if its payback period is shorter than the company’s target payback period.

What is a simple payback period?

It’s the time taken to recover the investment without considering the time value of money.

What is the difference between NPV and payback period?

- NPV measures overall profitability.

- Payback period measures how fast money is recovered.

They complement each other.

What is the difference between ROI and payback period?

- ROI shows total return.

- Payback shows time to recover investment.

You can link your ROI Calculator here.

Are ROI and EBIT the same?

No.

- ROI = Return on investment

- EBIT = Earnings before interest and taxes

What is the 10-year payback period?

It means the project takes 10 years to recover the investment.

What is an example of a payback period method?

Investment: $10,000

Inflow: $2,500 yearly

Payback = 4 years

How to calculate ROI and payback period?

- Calculate ROI using:

- Calculate payback using:

What are some examples of payback period?

- Solar panel: 7 years

- Coffee shop: 12 months

- Machine upgrade: 3.5 years

How do you interpret payback period results?

Shorter payback = lower risk + faster recovery.

What is a good payback period?

For most industries:

- Retail: Under 1 year

- Equipment: 3–5 years

- Energy/Solar: 6–8 years

- Startups: 1–3 years

What is the payback period for buying a business?

Depends on profits.

Typical: 2 to 5 years.

What are the 4 investment appraisal techniques?

- Payback period

- NPV

- IRR

- ROI

You can add internal links to all related calculators.

What is the 7% rule in investing?

Your investment doubles approximately every 10 years at 7% interest (Rule of 72).

What is the 10/5/3 rule of investment?

Typical annual returns:

- Stocks: 10%

- Bonds: 5%

- Cash: 3%

What is the meaning of IRR 12%?

Your project generates a 12% annual return, considering discounted cash flows.

Is IRR more accurate than payback period?

IRR is more detailed because it includes time value of money.

Payback is simpler and quicker.

Which is better: NPV, IRR or payback?

Use all three together for best analysis:

- Payback = speed

- NPV = value

- IRR = rate of return

What is the formula for calculating CAC?

CAC = Total Marketing Cost ÷ Number of New CustomersWhat is a good 10-year return on investment?

Generally 7–12% annually.

What is the rule of 70 in investing?

It estimates how quickly something doubles:

70 ÷ growth rate.

How to calculate period in Excel?

Use:

=NPER(rate, payment, present_value)How to calculate 5-year total return?

Total Return = (Final Value – Initial Value) ÷ Initial ValueWhat is 12% compounded monthly?

Equivalent annual yield =

(1 + 0.12/12)^12 – 1≈ 12.68%

What does a 70% ROI mean?

You earned 70% more than your initial investment.

What is a 7% annual return?

Your money grows by 7% per year.

Example: ₹100,000 → ₹107,000 after 1 year.

What is NPV of 10,000 at 7%?

NPV = Cash Flow / (1 + 0.07)^nHow to calculate NPV, IRR, and payback period?

You can compute all three using Excel or online calculators.

Add internal links to:

- NPV Calculator

- IRR Calculator

- Payback Period Calculator

FAQs

What is a payback period used for?

To find how long it takes to recover investment cost.

Is a shorter payback better?

Yes. Faster recovery = lower risk.

Does payback include interest?

Simple payback does not. Discounted payback does.

Is payback period the same as ROI?

No. Payback shows time; ROI shows total return.

Can payback period be negative?

No. You can only have longer or shorter payback.

What is a reasonable payback period?

1–5 years depending on industry.

Is payback period useful for startups?

Yes, especially to measure how quickly costs are recovered.

What is discounted payback?

A method that uses discounted cash flows for more accuracy.

Is payback better monthly or yearly?

Depends on the business. Retail and services use monthly; manufacturing uses yearly.

Why is payback period important?

It helps with budgeting, planning, and comparing investment options.

What happens after payback is achieved?

You start earning pure profit.

Which calculator should I use?

Use a Payback Period Calculator for fast and accurate results.

Use Our Other Calculators

“Use our Payback Period Calculator to compute this instantly.”

“You can also try our ROI Calculator to compare profitability.”

“Use the Discount Calculator when analyzing cost savings.”

Final Thoughts

The payback period is one of the most beginner-friendly and practical financial tools. Whether you are an entrepreneur, student, investor, or business owner, knowing how fast you recover your investment gives you confidence and clarity.

Using a Payback Period Calculator saves time, avoids manual errors, and helps you compare projects instantly. Always combine payback with ROI, NPV, and IRR to make smart, informed financial decisions.

This detailed guide should help you master the concept completely — with formulas, examples, tips, Excel tricks, and all major questions answered.

Thank you for reading this post, don't forget to subscribe!