Break-even Point Calculator

Calculatorsera.com

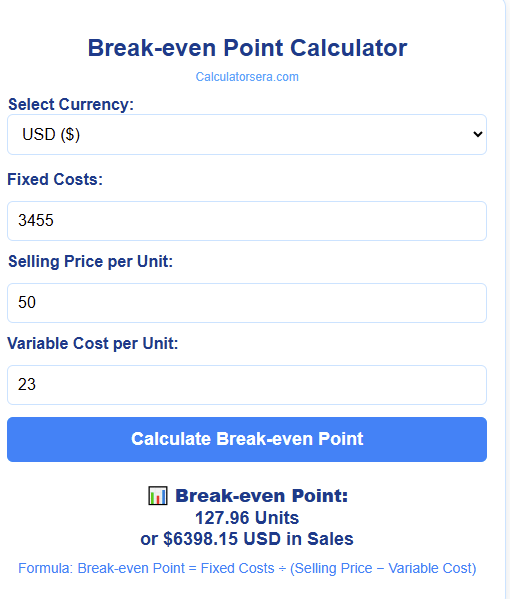

Formula: Break-even Point = Fixed Costs ÷ (Selling Price − Variable Cost)

Break-Even Point Calculator: Your Guide to Finding Your Business’s Profit Starting Line

Introduction

Break-even Point Calculator Ever wondered when your business will start making money instead of losing it? It’s like waiting for a rocket to finally leave the launch pad and soar into the sky. That exciting moment when you stop spending and start earning is called the break-even point.

And the best part? You don’t need to be a math genius to find it. This is where our Break-Even Point Calculator comes in. It’s a simple tool that does the hard work for you. It helps you find the exact moment your costs and your sales are equal. No profit, no loss. Just the perfect balance.

Think of it as your business’s GPS, telling you exactly how far you need to go to start making real money. Let’s dive in and learn all about it!

Table of Contents

What Is a Break-Even Point?

Break-even Point Calculator Let’s keep it super simple. The break-even point is the spot where your total income equals your total costs.

Imagine you have a lemonade stand.

- You spend $10 on cups, lemons, and sugar. These are your costs.

- You sell lemonade until you’ve made $10.

- The moment you collect that tenth dollar, you have reached your break-even point.

You haven’t made a profit yet, but you also haven’t lost any money. Everything you spent has been earned back. Every sale you make after this point is pure profit!

Businesses use this point to plan. It helps them answer big questions like, “Is my price right?” or “How many cupcakes do I need to sell to pay my rent?”

What Is a Break-Even Point Calculator?

Break-even Point Calculator Doing break-even math by hand can be confusing. That’s why we created the Break-Even Point Calculator.

It’s a free online tool that quickly figures out how many items you need to sell to cover all your expenses. You just type in a few numbers, click a button, and—voilà!—you get your answer.

This calculator saves you time and helps you make smart plans. It’s perfect for small business owners, shopkeepers, students, and anyone who wants to understand their finances better.

Why the Break-Even Point Matters

Knowing your break-even point is like having a secret map for your business. It’s important because it:

- Shows Your Profit Path: It tells you exactly when your business will become profitable.

- Helps You Make Decisions: Should you charge more? Can you afford to run a sale? Your break-even point gives you the clues.

- Reduces Your Risk: It helps you see potential problems before they happen. If your break-even point is too high, you know you need to make changes.

- Great for Startups: If you’re just starting a business, it helps you set realistic goals.

- Useful for Students: It’s a simple way to learn important business math.

Break-Even Formula (Simple Explanation)

Break-even Point Calculator Even though our calculator does the work, it’s good to know the magic behind it. The formula is:

Break-Even Point (in Units) = Fixed Costs ÷ (Selling Price per Unit – Variable Cost per Unit)

Don’t let those words scare you! Let’s break them down.

- Fixed Costs: These are costs that stay the same, no matter how much you sell. Think of rent for your shop, a monthly software subscription, or a salaried employee’s pay. It’s like a monthly membership fee for being in business.

- Variable Cost per Unit: This is the cost to make one single item. It changes depending on how many you make. This includes things like the materials for one product, the packaging for one item, or the labor directly involved in making it.

- Selling Price per Unit: This is simple! It’s the price you charge your customer for one item.

(Selling Price – Variable Cost) is also called the Contribution Margin. This is the amount each sale “contributes” to paying off your fixed costs.

Let’s do an example with our friend Sara:

Sara sells handmade candles.

- Her Fixed Costs (rent, website fee) are $1,000 per month.

- Her Variable Cost to make one candle (wax, wick, jar, scent) is $5.

- She sells each candle for $15.

First, find the Contribution Margin: $15 (Selling Price) – $5 (Variable Cost) = $10.

This means every time Sara sells a candle, $10 goes towards covering her $1,000 fixed costs.

Now, plug it into the formula:

Break-Even Point = $1,000 ÷ $10 = 100 units.

Sara needs to sell 100 candles each month to break even. Simple, right?

Chart Placeholder Section (Visual Guide)

A picture is worth a thousand words! The chart below shows a visual story of your break-even journey. You’ll see two lines: one for your Total Costs and one for your Total Revenue. The place where they cross is your break-even point!

Break-even Point Calculator *In this example chart, the fixed costs are $500. The Total Cost line starts at $500 and slopes upward as variable costs are added. The Total Revenue line starts at $0. They meet at 250 units sold—that's the break-even point! Everything above that is profit, and everything below is loss.*

How to Use the Break-Even Point Calculator (Step-by-Step)

Break-even Point Calculator Using our calculator is as easy as 1-2-3! Here’s how you do it:

Step 1: Enter Your Fixed Costs

Type in the total of all your fixed monthly costs. This includes things like rent, salaries, insurance, and utilities.

Step 2: Enter Your Variable Cost Per Unit

Input the cost of making one single product. This includes materials, direct labor, and packaging for that one item.

Step 3: Enter Your Selling Price Per Unit

Type in the price you charge your customer for one unit of your product.

Step 4: Click “Calculate”

Hit that button and let the magic happen!

Step 5: See Your Result

The calculator will instantly show you two things:

- The number of units you need to sell to break even.

- The amount of sales dollars you need to bring in.

Pro Tip: Play around with the numbers! See what happens if you raise your price by $2. Or what if you find a way to reduce your variable cost? The calculator lets you test different scenarios instantly.

Break-Even Analysis Example (Simple Story)

Break-even Point Calculator Let's follow Sara's full story with her cupcake shop.

Sara loves baking and decides to open "Sara's Sweet Cupcakes."

- Fixed Costs: Her shop rent is $800 per month. She also pays $200 for a business license and insurance. Her total fixed costs are $1,000.

- Variable Cost per Cupcake: For each cupcake, she needs flour, sugar, eggs, and a box. This costs her $1 per cupcake.

- Selling Price per Cupcake: She sells each cupcake for $3.

She uses our Break-Even Point Calculator:

Break-Even Point (Units) = $1,000 ÷ ($3 - $1) = $1,000 ÷ $2 = 500 cupcakes.

Sara now knows she needs to sell 500 cupcakes in a month just to cover her costs. She looks at her shop traffic and realizes she can only sell about 400. This is a problem!

But because she did this analysis, she can make a smart change. She decides to:

- Increase her price to $4 per cupcake, offering a unique frosting to justify the cost.

- Run a marketing campaign to attract more customers.

With a selling price of $4, her new break-even point is: $1,000 ÷ ($4 - $1) = $1,000 ÷ $3 = 333 cupcakes.

This new goal of 333 cupcakes is much more achievable! This is the power of break-even analysis.

Understanding Break-Even in Sales Dollars

Break-even Point Calculator Sometimes, it's more helpful to think in terms of money instead of units. The formula is easy:

Break-Even Sales ($) = Break-Even Units × Selling Price per Unit

Let's go back to Sara's first scenario where she needs to sell 500 cupcakes at $3 each.

Break-Even Sales = 500 units × $3 = $1,500.

So, Sara needs to make $1,500 in total sales revenue to break even. This is useful for setting sales targets for her team.

Factors Affecting Your Break-Even Point

Break-even Point Calculator Your break-even point isn't set in stone. It can change! Here are the main things that affect it:

- Fixed Costs: If your rent goes up, your break-even point goes up. If you find a cheaper office, it goes down.

- Variable Costs: If the price of your materials increases, you'll need to sell more to break even.

- Selling Price: Raising your price will lower your break-even point. Having a sale will raise it.

- Sales Volume: This is the result! It's how many you actually sell.

- Discounts & Promotions: A "buy one, get one free" sale changes your effective selling price, which changes your break-even point.

How to Lower Your Break-Even Point

Break-even Point Calculator A lower break-even point is better! It means you start making a profit sooner. Here’s how you can lower it:

- Increase Your Selling Price: If your customers see the value, they will pay more.

- Reduce Fixed Costs: Can you work from home? Negotiate a lower rent? This has a huge impact.

- Cut Variable Costs: Find a cheaper supplier for your materials. Improve your production process to waste less.

- Improve Efficiency: Do more with less. Use technology to save time and money.

- Offer Value-Added Services: Instead of lowering your price, add a small service that makes your product worth more.

Advantages of Knowing Your Break-Even Point

Knowing your number is a superpower. The advantages are huge:

- Smarter Financial Planning: You can create budgets and cash flow forecasts with confidence.

- Easier Pricing Strategy: You'll know the absolute minimum you can charge without losing money.

- Lower Business Risks: You can avoid big financial mistakes by seeing the red flags early.

- Better Forecasting: You can set realistic and motivating sales goals for yourself and your team.

- Helps with Investors: If you need a loan or an investor, they will be impressed that you know your numbers.

Break-Even Point in Real Life

This isn't just for big corporations! Everyone uses it.

- Small Bakery: Like Sara, they use it to figure out how many pastries to bake each day.

- Clothing Shop: They calculate how many t-shirts they need to sell to cover the cost of a new inventory shipment.

- Online Business: Someone selling handmade phone cases on Etsy uses it to see if their side business is actually profitable.

- Big Companies: Apple calculates the break-even point for every new iPhone model to decide on production numbers.

Break-Even vs. Profit Margin – What’s the Difference?

People often get these confused, but they're different.

- Break-Even Point: This is the moment or the number where you stop losing money and start your profit journey. It's the starting line for profit.

- Profit Margin: This is how much money you make after you've crossed the break-even point. It's the speed at which you are profiting.

Think of a race. The break-even point is the start line. The profit margin is how fast you run after crossing that line.

Break-Even Chart Visualization (Explained)

Break-even Point Calculator Let's go back to that chart. It tells a clear story.

- The Total Cost Line starts at your fixed costs and slopes upward. It goes up because as you make more products, you add variable costs.

- The Total Revenue Line starts at zero. The more you sell, the more money you make, so this line also slopes upward.

The beautiful moment where these two lines intersect is your break-even point. To the left of that point, the cost line is above the revenue line—that's the loss zone. To the right, the revenue line is above the cost line—that's the profit zone!

Who Can Use This Calculator?

Our Break-Even Point Calculator is for everyone!

- Small Business Owners planning their next move.

- Students learning about business, economics, or accounting.

- Freelancers trying to figure out how many projects they need to cover their living expenses.

- Startup Entrepreneurs testing their business ideas and creating pitches for investors.

- Teachers & Trainers explaining core business concepts in a simple way.

Common Mistakes in Break-Even Calculations

Break-even Point Calculator Watch out for these common errors:

- Forgetting Some Variable Costs: Don't forget small things like shipping fees or transaction costs.

- Using the Wrong Price: Make sure you're using the price after any common discounts or promotions.

- Not Considering All Fixed Costs: Did you remember your monthly internet bill? Your accounting software subscription?

- Ignoring Changes: Your costs and prices can change. Recalculate your break-even point regularly!

FAQs (Frequently Asked Questions)

What is the break-even point in business?

It's the point where your total sales revenue exactly equals your total expenses. There is no profit and no loss.

Why is it important to calculate the break-even point?

It's crucial for planning, pricing, and understanding the financial health of your business. It shows you the minimum performance needed to survive.

What are fixed and variable costs?

Fixed costs stay the same (like rent). Variable costs change with production (like raw materials).

How can I lower my break-even point?

You can lower it by reducing your fixed or variable costs, or by increasing your selling price.

Is break-even the same as profit?

No. Break-even is zero profit. Profit is the money you make after you have passed your break-even point

Can this calculator work for service-based businesses?

Absolutely! For a service business, your "unit" is an hour of service or a single project. Your variable cost might be the cost of materials for that project or a payment to a subcontractor.

How do startups use break-even analysis?

Startups use it to validate their business model. It helps them answer, "Is this idea even feasible?" and "How much funding do we need before we become profitable?"

Can I calculate break-even in dollars instead of units?

Yes! Our Break-even Point Calculator gives you both. The formula for break-even in sales dollars is: Fixed Costs ÷ Contribution Margin Ratio (which is Contribution Margin per Unit ÷ Selling Price per Unit).

Conclusion

Break-even Point Calculator Understanding your break-even point is one of the most important steps you can take for your business or your financial education. It turns guesswork into a clear, actionable plan. It tells you where the starting line is, so you can run your race towards profit with confidence.

Knowing your break-even point helps you plan smarter, price better, and grow faster. Stop wondering when you'll start making money. Try our free Break-Even Point Calculator now and find out when your business will start making real profit!

Visit calculatorsera.com and calculate your success today

Thank you for reading this post, don't forget to subscribe!