Budget Planner

Calculatorsera.com

Easily plan your monthly spending & savings with custom categories.

Your Ultimate Guide to the Budget Planner: Take Control of Your Money Today!

Ever reached the end of the month and wondered where all your money went? You had a paycheck, you paid some bills, but now your wallet feels empty. It’s a confusing and stressful feeling, right?

Don’t worry — you’re not alone! This happens to almost everyone at some point. The good news is there’s a simple, powerful tool that can solve this mystery: a Budget Planner.

Think of a budget as a map for your money. Without a map, you might wander around and get lost. With a map, you know exactly where you are and how to get to your dream destination—whether that’s a new car, a vacation, or just a life with less financial worry.

Here at Calculatorsera.com, we believe managing your money should be simple and stress-free. Our Budget Planner is a friendly, easy-to-use calculator that helps you track your income, expenses, and savings all in one place. It’s like giving your money a purpose and watching it grow!

Ready to become the boss of your bucks? Let’s dive in!

Table of Contents

What Is a Budget Planner?

Let’s start with the basics. What exactly is a Budget Planner?

In plain words, a Budget Planner is a simple tool that helps you plan where your money goes. It’s a plan for your cash. You tell it how much money you have, and then you decide where you want that money to go before you even spend it.

Budgeting is like giving every dollar a job. Instead of your dollars wandering off aimlessly, you assign them to important tasks. One dollar’s job might be to pay for lunch. Another dollar’s job might be to save for a new video game. A whole group of dollars might have the job of paying the rent.

A Budget Planner can be many things:

- A digital calculator, like the one on Calculatorsera.com.

- A spreadsheet on your computer.

- A simple notebook and pen.

- A mobile app on your phone.

No matter what form it takes, the goal is the same: to help you see your whole financial picture clearly.

Why Budget Planning Is So Important (It’s a Game-Changer!)

You might think budgeting is only for people who are struggling or for super-rich business people. But that’s not true! Budgeting is for everyone. It’s one of the most important life skills you can learn. Here’s why:

- Helps You Save More: A budget makes you aware of your spending habits. When you see where your money is going, you can find opportunities to save more, almost without trying!

- Helps You Avoid Overspending: It’s easy to overspend when you don’t have a plan. A budget acts like a friendly guardrail, keeping you on track and preventing you from spending money you don’t have.

- Keeps Track of Bills: Never miss a bill payment again! A budget helps you remember what’s due and when, so you can avoid those nasty late fees.

- Reduces Financial Stress: Money worries can keep you up at night. Knowing exactly where you stand financially brings a huge sense of peace and control.

- Helps You Achieve Your Goals: Want to travel the world? Go to college? Buy a home? A budget is your step-by-step plan to make those dreams a reality. You can’t build a house without a blueprint, and you can’t build your financial future without a budget.

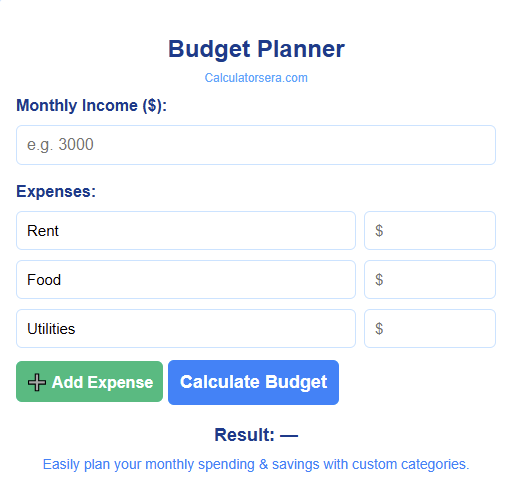

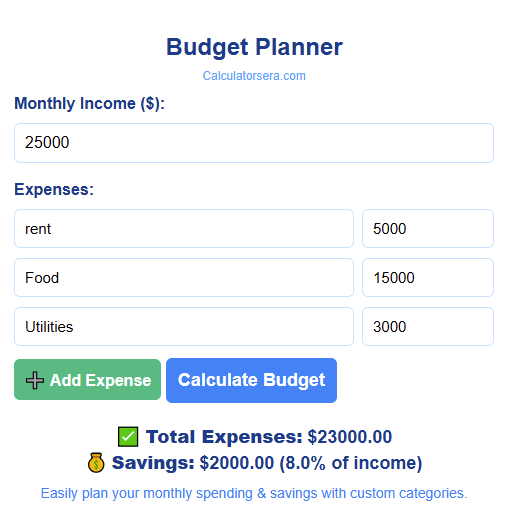

How Does the Budget Planner Work? (A Super Simple Step-by-Step)

Using our Budget Planner is as easy as pie. You don’t need to be a math whiz! Here’s how it works:

Step 1: Enter Your Monthly Income

This is the total amount of money you bring in each month. This includes your salary, allowance, or any side hustle money.

Step 2: List Your Expenses

Now, list everything you spend money on. This includes big things like rent, and small things like your morning coffee. We break it down into categories like Food, Transport, and Entertainment.

Step 3: Set a Saving Goal

What are you saving for? Tell the planner how much you’d like to save each month. This is your goal!

Step 4: The Calculator Does Its Magic

The Budget Planner instantly calculates everything. It shows you how much money you will have left over (your savings!) or if you are spending too much (overspending).

Step 5: Adjust Until Your Budget Balances

This is the fun part! If the planner shows you’re overspending, you can play around with the numbers. Maybe you decide to spend less on takeout this month. You adjust your expenses until your “Income” is greater than or equal to your “Expenses + Savings.” That’s a balanced budget!

The Budget Planning Formula (Explained So Simply)

All budgets are built on one, very simple formula. Are you ready for it?

Savings = Income – Expenses

That’s it! It’s just a fancy way of saying “What you keep is what you make minus what you spend.”

Let’s look at an example:

If you earn $2,000 (your Income) and you spend $1,600 (your Expenses), then you save $400.

$2,000 (Income) – $1,600 (Expenses) = $400 (Savings)

See? Not scary at all.

A Popular Way to Split Your Money: The 50/30/20 Rule

Now that you know the basic formula, how do you decide what to spend on? A famous and easy method is the 50/30/20 Rule. It’s a simple guide for splitting your income after taxes.

- 50% on Needs: These are things you absolutely must pay for to live and work. Think rent, groceries, basic utilities, and transportation.

- 30% on Wants: These are the fun things! Dining out, movies, hobbies, shopping for new clothes, and streaming services.

- 20% on Savings: This portion goes straight to your future. This includes your savings account, investments, or paying off debt faster.

This rule helps you create a balanced and sustainable budget without feeling like you’re depriving yourself.

Visualizing Your Budget

It’s one thing to read numbers, but it’s another to see them. A chart can make your budget crystal clear. The chart below shows how your monthly income can be divided using the 50/30/20 rule.

The pie chart above shows a sample budget where 50% of income goes to Needs, 30% to Wants, and 20% to Savings. Our Budget Planner can create a chart like this just for you!

Different Types of Budgets (With Easy Examples)

The 50/30/20 Rule is just one way to budget. Different styles work for different people. The great news is that our Budget Planner can be customized for any of these styles!

1. Zero-Based Budget

- How it works: Every single dollar of your income is assigned a job until you have zero dollars left to assign. It doesn’t mean you spend it all; it means every dollar is planned for, including savings and debt payments.

- Best for: People who love detail and want maximum control.

2. 50/30/20 Budget

- How it works: As we discussed, you split your income into three simple categories: Needs, Wants, and Savings.

- Best for: Beginners and anyone who wants a simple, balanced framework.

3. Envelope System

- How it works: You use cash for different spending categories. You put the cash for “Groceries” in an envelope labeled “Groceries.” When the envelope is empty, you stop spending in that category for the month.

- Best for: People who overspend with credit or debit cards.

4. Goal-Based Budget

- How it works: You start with a specific financial goal, like “Save $2,000 for a vacation.” You then work backward to figure out how much you need to save each month and build your entire budget around that goal.

- Best for: People motivated by a specific, exciting target.

How to Create a Budget in 5 Easy Steps

Let’s get practical. Here is a simple, universal guide to creating your first budget.

Step 1: Calculate Your Total Monthly Income

Add up all the money you receive in a month. If your income changes, use an average from the last few months.

Step 2: List Your Fixed Expenses

These are bills that cost the same every single month. They are easy to predict.

- Examples: Rent, car payment, insurance, internet bill, subscription services.

Step 3: Track Your Variable Expenses

These costs change from month to month.

- Examples: Groceries, gas, eating out, entertainment. Look at your bank statements from the last few months to get a good estimate.

Step 4: Set Your Saving and Investment Targets

This is the most important step! Pay your future self first. Decide on a specific amount or percentage to save and invest before you plan your fun spending.

Step 5: Review and Adjust Regularly

Your first budget won’t be perfect—and that’s okay! Life happens. Review your budget every week to see if you’re on track. At the end of the month, adjust your plan for the next month based on what you learned.

Example of a Simple Monthly Budget

Let’s put it all together with a real-life example. Meet Alex. Alex earns $3,000 a month after taxes. Here’s how Alex uses a Budget Planner:

- Income: $3,000

- Expenses:

- Rent: $900

- Groceries: $400

- Transport (Gas & Bus): $200

- Utilities (Phone, Electric): $150

- Insurance: $100

- Entertainment (Netflix, Dining Out): $150

- Savings Goal: $600

- Total Expenses & Savings: $900 + $400 + $200 + $150 + $100 + $150 + $600 = $2,500

- Remaining: $3,000 – $2,500 = $500

Alex has $500 left over! This money can be put into an emergency fund, used for a special gift, or added to the savings goal. The Budget Planner helped Alex see this clearly and feel confident.

The Amazing Benefits of Using a Budget Planner

Using a tool like our Budget Planner supercharges your money management. Here’s what you gain:

- Organized Spending: No more guessing. You know exactly where your money is going.

- A Saving Habit: Watching your savings grow in the planner is motivating and encourages you to save even more.

- Debt Prevention: By planning your spending, you avoid relying on credit cards for unexpected costs.

- Faster Goal Achievement: Whether it’s a down payment for a house or a new laptop, a budget gets you there faster.

- Peace of Mind: This is the biggest benefit. The relief of knowing you are in control of your finances is priceless.

Budgeting for Everyone: Families, Students & Freelancers

A one-size-fits-all budget doesn’t always work. The Calculatorsera.com Budget Planner is flexible enough for every lifestyle.

- For Families: Track shared expenses like groceries, kids’ activities, and family vacations. Our planner helps you see the big picture for the whole household.

- For Students: Manage your pocket money, part-time job income, and expenses for books and social life. Learning to budget now sets you up for a lifetime of success.

- For Freelancers: Handle irregular income with ease. You can plan for your “feast and famine” cycles by averaging your income and setting aside money from good months to cover the slower months.

Common Budget Mistakes (And How to Fix Them!)

Everyone makes mistakes when they start. Here are the most common ones and how to avoid them.

- Mistake 1: Forgetting Small Expenses.

- Fix: Track every coffee and snack for a week. Those small purchases add up!

- Mistake 2: Not Tracking Daily Spending.

- Fix: Check in with your budget for 5 minutes each day. It keeps you aware.

- Mistake 3: Ignoring Savings Goals.

- Fix: Treat your savings like a non-negotiable bill. Pay Yourself First!

- Mistake 4: Spending Before Saving.

- Fix: Set up an automatic transfer to your savings account as soon as you get paid. Then, live on what’s left.

Budget Planning Example: A Real-Life Case Study

Let’s see how a Budget Planner changed someone’s life.

Meet Sarah.

Sarah is a graphic designer who earns about $2,500 per month. She felt she was doing okay but had $3,000 in credit card debt she couldn’t seem to pay down. She was stressed and felt stuck.

Her Action Plan:

- She started using the Calculatorsera.com Budget Planner.

- She discovered she was spending over $400 a month on eating out and delivery apps!

- She created a new plan:

- Needs (50% – $1,250): Rent, utilities, car payment, minimum debt payments.

- Wants (30% – $750): She cut her eating out budget in half and found cheaper hobbies.

- Savings/Debt (20% – $500): She used this entire category to make extra payments on her credit card debt.

The Result:

By sticking to her plan and using the Budget Planner to track her progress every week, Sarah paid off her entire $3,000 credit card debt in just 4 months! She is now saving for a new car and feels financially free for the first time in years.

Smart Tips to Stick to Your Budget

Creating a budget is one thing; sticking to it is another. Here are some pro tips:

- Review Weekly: A quick weekly check-in is less overwhelming than a monthly one.

- Use Alerts: Set up phone alerts for bill due dates so nothing slips through the cracks.

- Avoid Impulse Buys: Implement a 24-hour “cooling off” rule before any unplanned purchase over $50.

- Automate Your Savings: Make saving effortless by setting up an automatic transfer from your checking to your savings account.

- Reward Yourself: When you hit a savings goal or stick to your budget for a month, celebrate! Use a little bit of your “Wants” money to treat yourself.

Fun Facts About Money & Budgeting!

- Did you know that about 60% of people don’t track their spending? By using a budget, you’re already ahead of the game!

- Budgeting isn’t new! People have been planning their finances since around 600 BC when the first coins were invented.

- Studies show that people who budget are 25% happier with their financial situation. Less stress = more happiness!

- The word “budget” comes from the old French word bougette, which means “small bag” or “purse.” It literally meant the contents of your wallet!

Conclusion: Your Financial Freedom Starts Here

So, there you have it! Budgeting isn’t about restriction or complex math. It’s about awareness, control, and making your money work for you. It’s the first and most important step toward achieving your dreams, big and small.

The Budget Planner on Calculatorsera.com is designed to make this journey simple, visual, and empowering. It turns the scary task of managing money into an easy, even enjoyable, habit.

Start planning your budget today — it’s not about limiting yourself, it’s about making your money work smarter!

Head over to our [Budget Planner tool] now and take the first step toward a brighter financial future. You’ve got this

Thank you for reading this post, don't forget to subscribe!