Loan Calculator

Calculatorsera.com

1. Introduction

Have you ever thought about buying a car? Or maybe your family is dreaming of a new home?

Thinking about a loan can be exciting. But it can also be confusing.

How much will you pay every month? How much interest will the bank charge? Doing this math with pen and paper is hard. It gives you a headache.

What if you had a super helper? A helper that does all the hard math for you in seconds.

That’s exactly what a Loan Calculator is!

It is a free online tool. It tells you exactly what your monthly payment will be. It shows the total interest you will pay. It makes everything clear and simple.

In this post, we will show you how our Loan Calculator on CalculatorSera.com works. It is your best friend for making smart money decisions.

Table of Contents

2. What is a Loan Calculator?

Let’s keep it simple.

A Loan Calculator is a smart online tool. You put in a few numbers about your loan. It instantly gives you the answers you need.

Think of it like a recipe. You add the ingredients, and it bakes the cake!

What answers does it give you?

- Your Monthly Payment (EMI): This is the fixed amount you pay the bank every month. EMI stands for Equated Monthly Installment.

- Total Interest Payable: This is the extra money you pay to the bank for borrowing from them.

- Total Payment: This is the loan amount plus all the interest. It’s the total cost of your loan.

A Simple Real-Life Example:

Imagine your friend Ali wants to buy a motorcycle. He takes a loan of $10,000. The bank says the interest rate is 10% per year. The loan is for 2 years.

Ali is confused. He doesn’t know how much he needs to pay each month.

This is where a Loan Calculator saves the day! Ali types in:

- Loan Amount: $10,000

- Interest Rate: 10%

- Loan Tenure: 2 years

The calculator instantly tells him his monthly EMI will be about $461. It also shows he will pay a total of $11,064. That means $1,064 is the interest.

Now Ali can plan his budget. He knows exactly what to expect.

3. How Does a Loan Calculator Work?

Our Loan Calculator is very easy to use. It works on a special mathematical formula. But don’t worry, you don’t need to know the formula. The calculator does all the work for you.

You only need to provide three simple pieces of information:

- Loan Amount: The total money you are borrowing from the bank. (e.g., $15,000 for a car).

- Annual Interest Rate: The cost of borrowing the money, shown as a percentage per year. (e.g., 8% interest).

- Loan Tenure: The total time you have to pay back the loan. You can enter it in years or months. (e.g., 5 years).

Once you click “Calculate,” the magic happens!

The calculator uses these three numbers to find out:

- Your monthly EMI.

- The total interest you will pay over the loan’s life.

- The total amount you will pay back (loan + interest).

It’s that simple. No confusion. No mistakes.

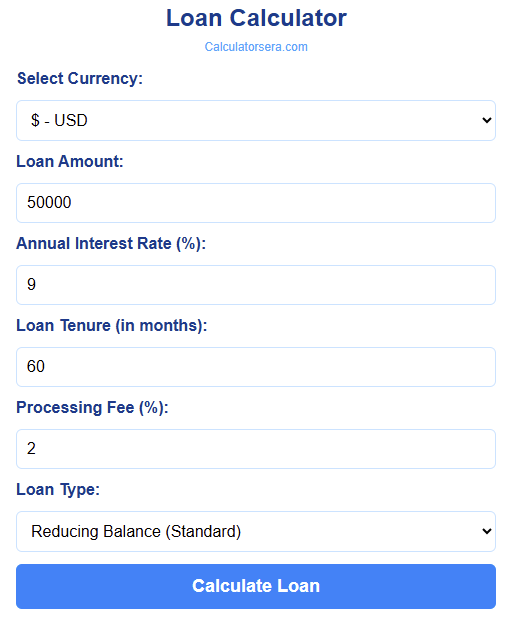

4. Step-by-Step: How to Use the Loan Calculator on CalculatorSera.com

Ready to try it yourself? Using our online loan calculator is as easy as 1-2-3. Let’s walk through it together.

Step 1: Enter the Loan Amount

In the first box, type the total amount you want to borrow. For example, if you need a personal loan of $5,000, just type “5000”.

Step 2: Enter the Interest Rate

In the next box, type the yearly interest rate your bank is offering you. For example, if the rate is 12%, just type “12”.

Step 3: Enter the Loan Tenure

This is how long you want to take to pay back the loan. You can choose years or months. For a 3-year loan, type “3” and select “Years”.

Step 4: Click “Calculate”

That’s it! Just click the button.

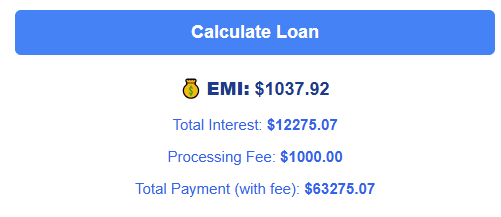

Step 5: View Your Results

Instantly, you will see your results:

- Your Monthly EMI: This is your fixed monthly payment.

- Total Interest Payable: This is the extra cost of your loan.

- Total Payment: This is the full amount you will pay back.

5. Loan Breakdown Chart

Numbers are great, but a picture makes it even clearer. That’s why our loan repayment calculator gives you a simple chart.

This chart shows you a secret. It shows where your money is going every month.

Loan Calculator

Calculate your monthly payments, total interest, and see your loan breakdown

Select a Loan Example

Loan Results

Amortization Schedule

| Month | Payment | Principal | Interest | Remaining Balance |

|---|

Let’s say your EMI is $461. This chart will show you that in the beginning:

- A large part of your payment goes to pay the interest to the bank.

- A smaller part goes to pay back the original loan amount (this is called the principal).

As time goes on, the chart changes. The interest part gets smaller. The principal part gets bigger.

This chart helps you see the true cost of your loan. It’s a powerful way to understand your finances.

6. Real-Life Examples

Let’s look at some common examples. This will show you how the Loan Calculator works in real life.

Example 1: The Car Loan

- Goal: Buy a new car for $20,000.

- Loan Amount: $20,000

- Interest Rate: 7% per year

- Loan Tenure: 5 years

Calculation:

- Monthly EMI: Our loan calculator shows the EMI would be about $396.

- Total Interest: Over 5 years, you would pay $3,790 in interest.

- Total Payment: You will pay a total of $23,790 for the car.

- What if you change the tenure? If you choose a 3-year loan instead, your EMI goes up to about $617, but your total interest drops to only $2,219! You save over $1,500.

Example 2: The Home Loan

- Goal: Buy a house with a $300,000 mortgage.

- Loan Amount: $300,000

- Interest Rate: 6% per year

- Loan Tenure: 20 years

Calculation:

- Monthly EMI: The monthly installment calculator gives an EMI of $2,149.

- Total Interest: This is a shocker! The total interest would be $215,838.

- Total Payment: The total cost of your house becomes $515,838.

This example shows how even a small change in interest rate can save you thousands of dollars.

Example 3: The Student Loan

- Goal: Pay for college with a $35,000 loan.

- Loan Amount: $35,000

- Interest Rate: 5% per year

- Loan Tenure: 10 years

Calculation:

- Monthly EMI: The EMI calculator shows a payment of $371 per month.

- Total Interest: You will pay $9,459 in interest.

- Total Payment: You pay back a total of $44,459.

7. Benefits of Using an Online Loan Calculator

Why should you use our calculator? Here are the top benefits:

- It Saves Time: No more complicated math. Get answers in seconds.

- It’s 100% Accurate: Humans can make mistakes. Our calculator won’t. The numbers are always correct.

- It’s Free to Use: You can use it as many times as you want, for free.

- It Helps You Plan Your Budget: Knowing your EMI helps you decide if you can afford the loan.

- It Lets You Compare Loans: You can check different banks and their interest rates. See which loan is best for you.

- It Shows the True Cost: Seeing the total interest helps you understand the real price of your purchase.

- It Works for All Loans: You can use it for a personal loan, car loan, home loan, or education loan.

8. EMI Calculation Formula (Explained Simply)

For those who are curious, here is the formula that the calculator uses. Don’t be scared! We will explain it in a simple way.

The EMI formula is:

EMI = [P x R x (1+R)^N] / [(1+R)^N – 1]

Now, let’s break down these letters:

- P stands for Principal Loan Amount. This is the money you borrow.

- R stands for Monthly Interest Rate. You get this by dividing your yearly rate by 12. For example, if the yearly rate is 12%, the monthly rate (R) is 12%/12 = 1% or 0.01.

- N stands for Loan Tenure in Months. For a 2-year loan, N would be 24 months.

Let’s use Ali’s example:

- P = $10,000

- Yearly Rate = 10%, so Monthly Rate R = 10/12/100 = 0.00833

- N = 2 years * 12 = 24 months

Putting it in the formula:

EMI = [10000 x 0.00833 x (1+0.00833)^24] / [(1+0.00833)^24 – 1]

The answer is $461.45.

See? It’s complicated! This is why using our online loan calculator is the best choice. It does this hard work for you.

9. Tips to Manage Loan Payments Better

Now that you are a loan expert, here are some tips to save money:

- Choose a Shorter Tenure: If you can afford a higher EMI, pick a shorter loan term. You will pay much less total interest.

- Shop for the Best Interest Rate: Don’t just go to one bank. Use the interest calculator to see how different rates change your payment.

- Make Prepayments: If you get extra money, like a bonus, pay off a part of your loan early. This reduces your total interest.

- Read the Fine Print: Some loans have hidden fees. Always ask about processing fees or other charges.

- Recalculate if Rates Change: If your loan has a floating interest rate, use the calculator again when the rate changes.

Frequently Asked Questions (FAQs) For Loan Calculator

What is a loan calculator used for?

A loan calculator is used to find out your monthly loan payment (EMI), the total interest you will pay, and the total repayment amount. It helps you plan your budget before taking a loan.

Can I calculate both personal and car loans?

Yes! You can use our calculator for any type of loan where you have a fixed interest rate and tenure. This includes personal loans, car loans, home loans, and education loans.

Does the calculator show total interest?

Absolutely! Our calculator shows three main things: your monthly EMI, the total interest amount, and the total payment (loan + interest).

Is the EMI fixed or does it change over time?

For most common loans like personal, car, or home loans, the EMI amount is fixed for the entire loan period. It does not change.

Is the CalculatorSera Loan Calculator free?

Yes, it is completely free to use. You can use it as many times as you need without any cost.

Can I use it on my mobile phone?

Yes, our website and loan calculator are mobile-friendly. You can easily calculate your EMI on your phone, tablet, or computer.

11. Conclusion

Taking a loan is a big step. But it doesn’t have to be scary or confusing.

With a Loan Calculator, you have the power of knowledge. You can see your future payments. You can plan your budget. You can make smart choices with your money.

Our free Loan Calculator on CalculatorSera.com is here to help you. It is simple, accurate, and easy to use.

So, what are you waiting for?

Go ahead, try it now! Enter your loan amount, interest rate, and tenure. See how easy it is to take control of your financial future. Happy calculating

Thank you for reading this post, don't forget to subscribe!