Advanced EMI Calculator

Calculatorsera.com

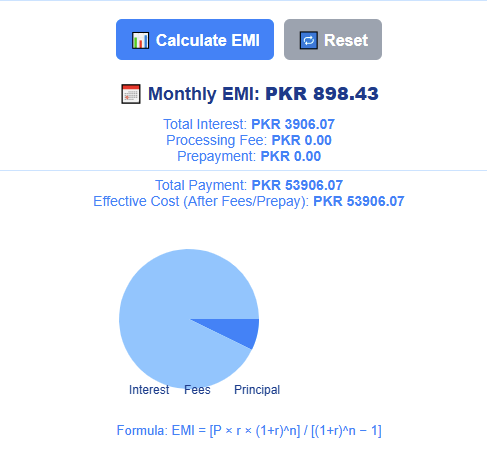

Formula: EMI = [P × r × (1+r)^n] / [(1+r)^n − 1]

EMI Calculator: Your Super-Simple Guide to Loan Payments

Have you ever wanted to buy a new bicycle, a smartphone, or even a house, but didn’t have all the money at once? That’s where loans come in! And when you get a loan, you hear a special word: EMI.

What is an EMI? It stands for Equated Monthly Installment. Think of it as a fixed, monthly payment you make to the bank until your loan is completely paid back. It’s like a monthly subscription, but for your loan!

Figuring out how much that monthly payment will be can seem tricky. But don’t worry! That’s exactly what an Equated Monthly Instalment Calculator is for. It’s a free online tool that does all the hard math for you, instantly. Let’s learn how it works!

Table of Contents

What is an EMI Calculator?

An EMI Calculator is like a smart robot that instantly tells you your exact monthly loan payment. You just need to give it three simple pieces of information:

- Loan Amount: The total money you want to borrow (like ₹5,00,000 for a car).

- Interest Rate: The small extra percentage the bank charges you for lending the money.

- Loan Tenure: How many years (or months) you want to take to pay the loan back.

Once you enter these details, the calculator magically shows your EMI. It’s that easy!

How Does an EMI Calculator Work?

While you don’t need to know the math to use the calculator, it’s interesting to see what happens behind the scenes. The calculator uses a special formula.

Here is the EMI formula it uses:

EMI = [P x R x (1+R)^N] / [(1+R)^N-1]

Now, let’s break down this alphabet soup into simple words:

- P stands for Principal Loan Amount (the big number you borrowed).

- R stands for Monthly Interest Rate (your yearly interest rate divided by 12).

- N stands for Loan Tenure in Months (how many months you’ll be paying).

A Simple Example:

Let’s say you borrow ₹1,00,000 for 1 year at a 10% annual interest rate.

- P = ₹1,00,000

- R = 10%/12 = 0.00833 (the monthly rate)

- N = 12 months

The calculator crunches these numbers and tells you your monthly EMI would be about ₹8,792.

But remember, you never have to do this manually! The online EMI Calculator on Calculatorsera.com handles it all in a flash.

A Step-by-Step Guide: How to Use an EMI Calculator

Using our calculator is as easy as 1-2-3! Here’s how:

- Enter Your Loan Amount: Type in the total amount you plan to borrow. For example, ₹5,00,000.

- Type Your Interest Rate: Input the annual interest rate offered by your bank. For example, 8.5%.

- Choose Your Loan Tenure: Select how many years you want to repay the loan, like 3 years.

- Click “Calculate EMI”: That’s it!

Instantly, you will see:

- Your Monthly EMI.

- The Total Interest you’ll pay over the loan’s life.

- The Total Payment (Principal + Interest).

Visualizing Your EMI: Principal vs. Interest

Your monthly EMI isn’t just paying back the money you borrowed. A part of it goes toward the loan amount (principal), and a part goes toward the interest cost.

The chart below shows you a simple breakdown of how a typical EMI is split.

EMI Payment Breakdown

Visual representation of your monthly installment components

Principal Repayment

Amount that reduces your actual loan balance

Interest Payment

Cost of borrowing paid to the lender

Longer tenure increases interest component, shorter tenure increases principal component

As you can see, in the early years, a larger chunk of your EMI goes toward paying the interest. Over time, more and more of your payment starts reducing the principal amount.

Top Benefits of Using an Online EMI Calculator

Why should you use an EMI Calculator? Here are the fantastic benefits:

- Saves Time & Effort: No more complex math or confusion.

- Helps Plan Your Budget: Know your exact monthly payment to see if it fits your budget.

- Compare Loan Offers: Easily check how different interest rates or tenures change your EMI.

- Clear Financial Picture: See the total interest you will pay, helping you make a smarter decision.

- Free & Instant: Our EMI Calculator on Calculatorsera.com is 100% free and gives results in seconds.

Real-Life Examples of Using an EMI Calculator

Let’s make this even more real with some everyday stories:

- Example 1: The New Laptop

- Scenario: Rohan, a college student, wants to buy a new laptop for ₹80,000.

- Calculation: He uses the personal loan EMI calculator with a 12% interest rate and a 2-year tenure.

- Result: He finds his EMI will be ₹3,767 per month, which helps him plan his part-time job income.

- Example 2: The Family Car

- Scenario: The Sharma family is getting a car loan of ₹8,00,000.

- Calculation: They use the car loan EMI calculator with a 9% interest rate for 5 years.

- Result: They see their monthly payment will be ₹16,607 and the total interest paid will be ₹1,96,420.

- Example 3: The Dream Home

- Scenario: Priya is planning to take a home loan of ₹50,00,000.

- Calculation: She tries different tenures in the home loan EMI calculator at an 8.5% rate. For 20 years, the EMI is ₹43,391. For 15 years, it’s ₹49,294.

- Result: She can choose the tenure based on what monthly payment she is comfortable with.

Different Types of EMI Calculators

The core formula is the same, but we have special calculators for different needs:

- Home Loan EMI Calculator: Perfect for planning your house purchase.

- Car Loan EMI Calculator: Designed for calculating your vehicle loan payments.

- Personal Loan EMI Calculator: Ideal for weddings, vacations, or other personal needs.

- Education Loan EMI Calculator: Great for students and parents planning for college fees.

Smart Tips for Managing Your EMIs

- Choose a Comfortable Tenure: A longer tenure means a lower EMI, but you pay more total interest. A shorter tenure means a higher EMI, but you save on interest.

- Make Prepayments: If you have extra money, paying a part of your loan early can reduce your total interest.

- Compare Interest Rates: Always check rates from multiple banks before deciding.

- Check the Total Interest: Use the loan repayment calculator to see the total cost of your loan, not just the monthly EMI.

Frequently Asked Questions (FAQs)

What is EMI in simple words?

It’s the fixed amount of money you pay to the bank every month to repay your loan.

How is EMI calculated?

It’s calculated using a standard formula that considers your loan amount, interest rate, and tenure. The easiest way is to use an online EMI Calculator.

Can I use the calculator for any loan type?

Yes! Our calculator is versatile. You can use it to calculate monthly EMI for home, car, personal, or education loans.

Is the EMI Calculator free?

Absolutely! It is 100% free to use on Calculatorsera.com.

What happens if I pay my EMI early?

Paying early reduces your total principal amount, which means you will pay less interest overall and can close your loan faster.

Conclusion: Plan Smarter with the EMI Calculator

Understanding your loan payments is the first step to smart financial planning. An EMI Calculator takes away the guesswork and gives you clear, accurate numbers in seconds. It empowers you to make the best decision for your budget and future.

Why wait? Take control of your finances today — use the EMI Calculator on Calculatorsera.com now and plan smarter!

Thank you for reading this post, don't forget to subscribe!